Betway Bulgaria: Start of the Biggest Market in Southeast Europe?

There is a decades-old traditional Bulgarian saying: “Капка по капка, вир става” - its pronunciation being “Kapka po kapka, vir stava.”

Translated, it essentially means, ‘if you want to be successful, you have to be patient.’ The Bulgarian online gambling industry could certainly be a testament to this - unbeknown to many, this has been legal in the country since 2008, though fresh regulation was initiated in 2012. Regulated by the Bulgarian National Revenue Agency (NRA) since 2020, took over from the State Commission on Gambling (SGC) in a bid to establish a tighter grip on the industry.

Like most countries across Europe that have introduced online gambling over the last decade, it has been a case of steady progression and careful observation for operators, monitoring the market and analyzing trends so that they can make sure they are able to deliver the right gambling products to customers.

Of course, in each country, there are many differences in terms of what customers prefer from their online gambling experiences, reflected by the culture, behaviors, and even influences. For example, one country may have a strong leaning towards online poker, while another that has a strong football following, for example, with many different clubs that play in a major competition, might attract a lot of football bets.

In addition, other factors also play a part, such as the development of infrastructure in different verticals and economic performance. Indeed, a report published in 2018 revealed, via the Bulgarian Trade Association of Manufacturers and Operators in the Gaming Industry (BTAMOI), a 17% year-on-year rise in terms of revenue for the previous 12 months. As a result, operators paid €57 million in taxes to the government, with BTAMOI issuing a press release that explained: “For the period 2017/2018, the gaming industry in Bulgaria has shown very good results at national level, based on the country’s upward economic performance.”

At the time, online gambling in the country represented only 10% of the total gambling market, though this has since grown in line with a surge in major operator interest in addition to a number of other complementary factors.

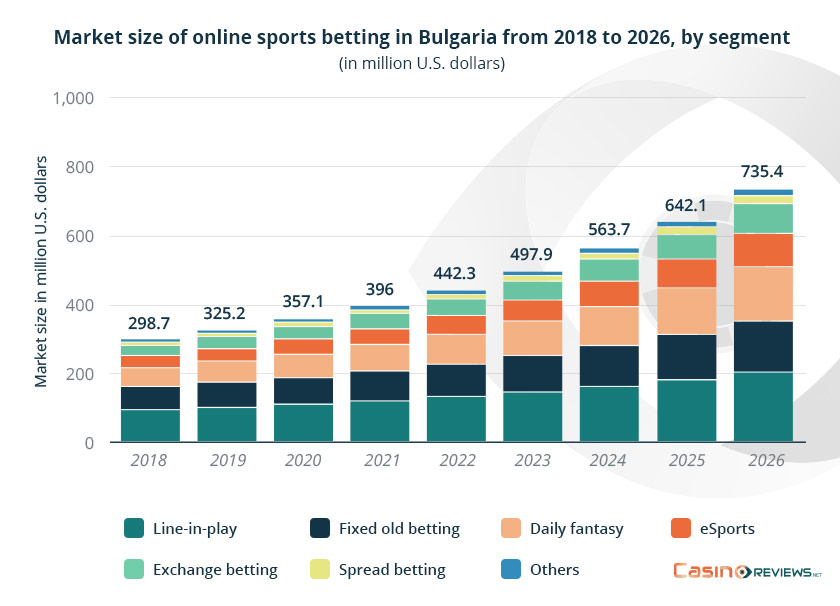

The surge in interest across the many different segments of online gambling since 2018 has been particularly strong, with figures according to Statista reporting growth in market size over four years of nearly $150 million. By 2026, it is predicted that the market will reach (USD) $735.4 million, a clear sign from industry analysts of how big this can become.

What cannot be ignored is that in terms of the territory that Bulgaria operates in (southeast Europe) and, by extension, the Balkans, it is one of the biggest emerging markets when it comes to online gambling, helped in recent years by the emanation of new technology and marketing companies, that have identified the online gambling niche as one that has serious potential.

Betway’s Business Strategy

Following Super Group-owned Betway’s recent launch in the Bulgarian market, it has led many insiders to speculate that this could act as a trigger for further overall growth and when considering the pulling power that the brand itself has, in addition to its influence on the wider industry, there is some reasoned logic behind this.

In recent years, Betway has become one of the leading brands in Europe - Bulgaria is now the 12th country that it has launched in, and they are steadily developing an almost iron-clad grip in a number of territories.

Its business strategy has served the company particularly well over the last decade, focusing on a different approach to branding and marketing, which helped to catapult it into public consciousness.

Potential of the Bulgarian Betting Market

One of the key reasons why this could have a major influence on the Bulgarian market is because of its well-known sponsorship of some of the continent’s most recognizable football clubs in countries such as Germany, France, and Spain, while recently expanding onto the international stage.

In terms of popular online gambling niches in Bulgaria, Betway is betting on the fact that the country’s interest in football can help to boost customer acquisition for a brand that residents are already familiar with - this thereby acting as a hook to then be able to effectively raise the awareness of its other industry-leading products.

Betway is not the only operator that is beginning to realize the potential of Bulgaria, with Malta-based start-up SportingWin having recently launched in the country with this view being particularly echoed by Head of Investment and Board Director Mark Chakravarti.

Recently speaking about the growth figures that he anticipates, he expanded on this, revealing prior to the brand launching: “When we spoke about annual industry growth of 20%, we were only referring to the sports betting vertical. For online casino, we actually expect growth to out-pace sports at around 30% each year – this is why we have identified Bulgaria as having the greatest growth potential of all emerging European markets.”

There are a number of similarities between Betway and SportingWin, and these are highlighted in terms of the effect that they can have on helping to assist in catapulting the Bulgarian online gambling industry into the European limelight, with technology, it seems, especially proving to be at the forefront of brand expansion.

As we have yet to launch, I can’t comment on how this has been reflected in our operational activity, but I can say that we believe a key driver of growth in the sports betting vertical will be the return of exchange betting in the country, which we will deliver through our proprietary platform and market-leading proposition.

One thing that brands will need to understand about the Bulgarian market is the difference in buying behavior compared to other countries - especially those where online gambling has just been regulated. This is something in particular that Chakravarti was keen to emphasize.

Bulgarian players are savvy and discerning, and they demand the same range of betting products and opportunities as those in more established markets. By providing these, we will be able to claim a large share of the market while also driving growth.

It does appear that Betway has some competition in Bulgaria, though this is not necessarily a bad thing. Understanding and recognizing the potential that the market has is something that both brands are in-sync with. The most intriguing factor perhaps being that SportingWin is still very much in its infancy as a brand.

Conversely, Betway has been around since 2006 - essentially right at the start of the ‘online gambling’ revolution in the UK, around a time that saw many new iGaming brands enter what had clearly been anticipated to be an industry that could have a major disruption in the global economy.

Advertising, Sponsorship and Brand Ambassadors

With each company developing its own unique style and approach to marketing and customer acquisition, Betway quickly identified a new approach in the iGaming industry to help propel them further towards the stratosphere at a quicker rate. Sponsorship of sports teams that it was effectively promoting on its site, via offering customers the chance to gamble on them, proved to be highly useful customer acquisition and retention channels.

In addition, signing well-known brand ambassadors that featured in clever advertising commercials further helped to assist in not only customer acquisition but also brand recognition.

Once this model worked in the UK, the brand focused on other markets across Europe, becoming one of the fastest-growing iGaming sites in the industry (in terms of geographical scale), applying the same approach each time.

The success of this has enabled them to really commit further effort to its online gambling offering, having signed deals with some of the best software providers in the industry. What has been clever about this approach is the strategic method that Betway has adopted.

Instead of just signing agreements with software providers for sites in each of its territories, the carefully executed market research it has done provided the brand with prior knowledge about the type of slots and casino games each market would like and, as a result, signed software providers accordingly for each region.

This is one tactic that Betway could find works, particularly to its advantage, especially in Bulgaria, where, as Chakravarti revealed, customers are “especially savvy.”

Bulgaria vs the Challenging Markets in Southeast Europe

Many perhaps will not have realized that this pocket of the continent has witnessed a surge in new, regulated markets, in addition to mounting interest, which has attracted a number of the industry’s biggest brands.

In June 2021, online gambling and sports betting became legal and regulated in Greece after 20 years, and it has witnessed a strong year. Indeed, one of the flagship brands, Betsson, was quick to apply for and be granted a license from the Hellenic Gaming Commission. Interestingly, Betway has yet to provide any sign of interest in that direction.

President and chief executive for Betsson provided insight at the time as to why his firm had identified Greece as a key market in this region of Europe and the impact that he felt that it could have: “We are really pleased to receive these licenses and to welcome Greece as Betsson’s 18th locally regulated market. As in other markets, our vision for Greece is to offer the best customer experience possible, and we have partnered with some great gaming suppliers and payment providers to augment our offering. The Greek gaming market has experienced significant growth over the past years, and we see a lot of potential.”

This certainly makes for a curious analysis. Betway - a brand that has essentially mastered customer acquisition in a number of key European territories, as yet, deciding against applying for a Greek license and instead focusing on Bulgaria, compared to an operator that has existed for nearly 60 years.

Croatia is a market that could very quickly provide competition. Currently, with relaxed online gambling laws, the country may be primed for significant development in the iGaming industry before too long, especially considering its popularity.

Indeed, software provider Gaming Corps’ Chief Commercial Officer, Mats Lundin, speaking about the company’s recent partnership with Croatian brand, Supersport, revealed the impact that Croatia could have on the wider industry: “Croatia is a growing market with so much potential, and I can think of no better way to establish our presence there than partnering with the competent team at Supersport,” he stated.

Investment Potential and Importance of Technology in Bulgaria

One of the biggest contributory factors to the success of a particular iGaming market is how much of a draw it is for investors, based on a number of variables. Arguably one of the biggest developments in the Bulgarian online gambling market in recent times and essentially a clue as to how valuable this could be is the recent acquisition of native software developer Silverback Gaming by US giant GAN.

GAN president and CEO Dermott Smurfit paid tribute to how advanced and sophisticated the online gambling market in Bulgaria is, following news of the acquisition, revealing: “Silverback has built its reputation in this industry as a leading slot design innovator, and we welcome the team’s talent, including slot mathematicians and software engineers, which will be an invaluable long-term asset as we build upon our strategy of expanding our exclusive online slot games for distribution in the US.”

Having only been founded in 2019, the fact that the technology provider was successfully purchased two years later is a testament to the strength of the Bulgarian market and the amount of talent that is at its disposal.

Silverback Gaming Co-Founder, Ivaylo Karmazov, shed more light on this, explaining: “There are a few main reasons why a wide number of companies from the gaming industry are currently locating their tech teams in the CEE (Central Eastern European) region. Firstly, the very high level of seniority and understanding of certain technologies powering their products. Secondly, the software academies, such as the Telerik Academy based in Sofia, that constantly organize courses preparing new talents.”

A lot has been said about the potency of the world-renowned Silicon Valley in California and the possible impact that this could have on the swiftly growing US online gambling market, though the influence of the Bulgarian technology scene clearly cannot be underestimated.

Software development companies have become essential to how the online gambling industry works, and places like Sofia could progress to be somewhat of a hub - even servicing the entire region of southeast Europe over the next few years in the industry.

Future of iGaming Growth in Bulgaria

The next few years are, without a doubt going to be interesting in terms of how the industry evolves in the country, not just on a global scale. Betway’s entry into the market could act as the pivot, and just how this is interpreted nationally and the influence that it may already have had on prospective customers via its clever branding strategy remains to be seen.

Currently, only a handful of operators are available to customers in the country, which has a particularly strict policy when it comes to approving licenses for new online gambling companies.

At a time when so many countries are passing online gambling legislation, having seen the financial benefits that the industry can bring in the form of taxation from operators, the time has never been more exciting for the industry, and Bulgaria has shown that it is well-equipped to be able to handle itself. Patience, it seems, is a virtue.

Review this Blog

Leave a Comment

User Comments

comments for Betway Bulgaria: Start of the Biggest Market in Southeast Europe?