888Africa: A Considerable Risk or the Start of a Major New Market?

The last 12 months have been hectic for online gambling giant 888 Holdings (LON: 888), following the acquisition of William Hill’s non-US assets, followed by moves into a number of strategic markets. Though, has the company taken its most adventurous risk yet?

One that, if successful, could launch it into the stratosphere to compete with the likes of leaders in quite a few industry markets; Entain and Flutter Entertainment. Perhaps one of the last untapped territories in the world, for a number of sectors, Africa has now become a hotbed for investors in the increasingly popular online gambling industry.

Of course, for this to succeed, like anything, the continent needs the requisite infrastructure, and over the last few years, we have seen a number of foundations laid across other sectors in order to accommodate this.

A continent that is naturally rich in resources, though one with considerable political instability in many different countries, causing the creation of dictatorships, significant poverty gaps, and even corruption, Africa has multiple attractive draws.

The Background

The last few years, despite being behind most of the rest of the world, have seen a number of African countries develop their main infrastructure, with the TMT (Technology, Media, Telecommunications) sectors really taking off in key countries.

Indeed, between 2000 and 2012, the number of mobile phone subscribers in Africa rocketed by 2500 percent, with this, in turn, helping to pave the creation of a demand for a further industry on the continent – e-commerce.

Without a doubt, each of these factors has a number of effects on how the emergence of the online gambling industry in Africa has unfolded; it was no coincidence that the vast improvement in telecommunications and broadband capabilities were major influences.

Although this has led to a considerable amount of money being invested, not only by native entrepreneurs but also by foreign, there are also a number of hurdles that stand in the way in many of the countries on the continent.

Birth of 888Africa

In what is likely to be one of the most ambitious projects in the online gambling industry in recent years, 888 Holdings has launched its joint venture, 888Africa, with quite a few other parties coming aboard - the risk share is a potentially smart move.

Partnering with key and influential members in the online gambling industry; ex-Chief Marketing Officer and Chief Customer Officer of the Stars Group, Christopher Coyne, ex-Managing Director of sportsbook at the Stars Group and current chairman of Voxbet, Andrew Lee, and former Editec Online Chief Product Officer, Alex Rutherford, the venture has essentially compiled what on paper, at least, appears to be somewhat of an all-star team.

This certainly appears to be the general consensus, according to 888 Holdings Group Chief Itai Pazner, who gushed about the possibilities surrounding this new venture.

“We are very excited to establish 888Africa alongside such an impressive roster of industry talent,” the 888 Chief Executive revealed.

“The new JV will launch 888’s world-class online betting and gaming brands to millions of new customers in the exciting and fast-growing African online market.”

He continued: “The structure of this deal enables the Group to invest in a strong business with high growth ambitions, without distracting focus from our core business and key strategic markets. We look forward to being a part of 888Africa’s journey as it grows its footprint and increases brand awareness while also offering potentially significant long-term opportunities for the Group in the future.”

As an entity, 888 does not actually hold a majority stake in the venture. However, stipulations have been written in that this could become a possibility over the course of the next few years. What it means, therefore, is that there is a great opportunity for the three other stakeholders in the project to build a highly successful brand in the four markets that it will operate in, initially, subject to licensing, then potentially cash out significantly.

The plan for 888Africa is to lease the betting and gambling software from 888 Holdings, subsequently operating their brands in these markets via a third-party technology platform. However, in line with cultural product preferences in the African market, these will be tweaked according to market research and data analysis. This could mean any new slots are likely to be the subject of in-depth market research based on historical customer behavior.

With regulated markets being targeted upon launch this year, the hope will be that the demand is for a new brand with a credible, reputable name and a good standing in the global online gambling industry, namely the pedigree of 888, providing what will hopefully be a magnetic effect.

How Will Legislation Have an Impact on Future Growth?

The names of the markets that 888Africa will launch in have not yet been disclosed. However, at least South Africa appears to be the most likely, while Ghana, Nigeria, and Kenya are also thought to be in the running - each of these being regulated markets.

The collective population of each of those four countries amounts to an estimated 363 million, according to the World Population Review - for context, that is just over six times the population of the UK.

Obviously, just like in the UK gambling market (one of the largest markets for online gambling and sports betting in the world), not everyone in those four African markets will participate in the activity, especially when accounting for even larger poverty gaps in each of these countries - despite these being some of the more economically advanced, with a higher percentage of the middle class.

There are, of course, a vast number of countries on the continent where regulation is not viable, especially given the political instability in a number of these. While online gambling might still exist and be offered in countries such as these, it is likely that these sites are unsafe.

Unregulated African online gambling markets may also be intertwined with crime, gang warfare, corruption, or have a local ‘mafia’ influence at the very least, which would make the idea of these becoming regulated very unlikely, or not until existing government regimes are overthrown.

Then, there are a number of Muslim countries where in line with the Quran, gambling is considered to be a sin, while Egypt represents an interesting talking point. Although nationals are prohibited from taking part in gambling apart from the state lottery, it does play home to a number of land-based casinos for tourists and foreigners only.

In terms of license approval for 888Africa in their target markets, it remains to be seen what the process is. For European-based brands that operate in other markets, such as the US, for example, it is required that they have a partnership in place with a local land-based casino in the particular state in order to operate and offer online services to customers.

Whether this will be the case in African countries is something that is still to be revealed, though there will be some financial benefit for that particular country - perhaps a high tax rate.

Despite this, Pazner certainly seems to think that it is worth the gamble. He does not appear to be too concerned about it distracting the company from its main focus of continuing to build throughout Europe and establishing itself in the ever-growing US and Canadian markets.

For now, it appears that the new brand will be focusing its efforts on four key markets, and any others that become regulated over the next few years will be a bonus.

Investments in the African Online Gambling Industry

Playing home to numerous emerging economies, even on a global scale, Africa is one of the most intriguing prospects when talking about the subject of globalization and macroeconomics.

What appears to be the case is that we are set for the next big land-grab in world history, which could span decades, and will likely shape the course of a generation. Technology is finally starting to make a major impact on the continent - a number of companies have realized how to best utilize the many numbers of natural resources at their disposal in different countries.

Laying the infrastructure and foundations to build on these thriving cities across the continent - Nigeria’s Abuja, Kenya’s Nairobi, and South Africa’s Cape Town are major financial hubs for the industries to maximize their potential.

That is the keyword for investors - ‘potential’ - especially for the online gambling industry on the continent. We have seen in other key markets over the years that there were crucial developments in industries that paved the way for the success of the online gambling industry, and it appears that Africa is following a similar trajectory.

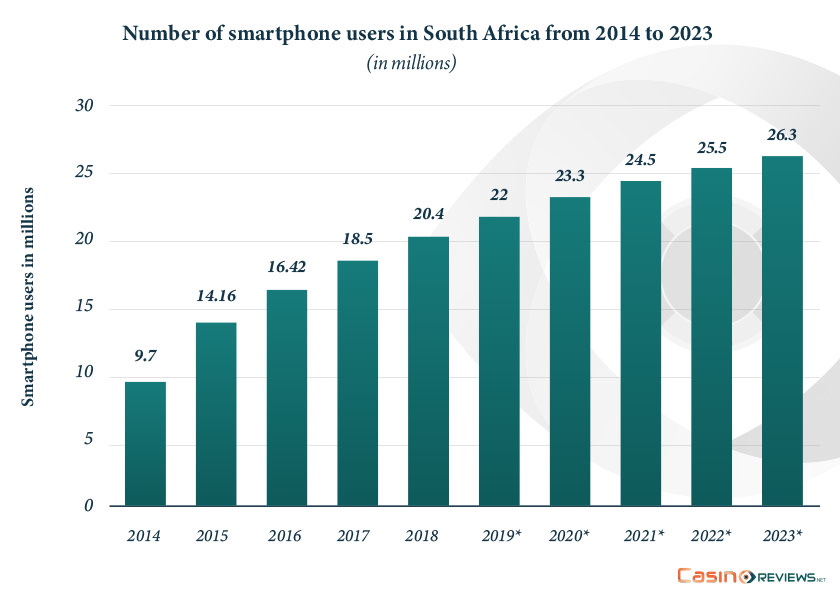

Certainly, the growth in the number of people with smartphones on the continent - especially in the four likely countries where a license will be granted - is going to be key to the success of the industry. Good news for 888.

Perhaps what should not be so easily overlooked is the role that Africa plays in the global fintech (financial technology) industry - indeed, it is home to over half of the world’s registered mobile money customers, with Sub-Saharan Africa accounting for over 80 percent of global money transactions during 2018.

This alone could account for the reason why such investment has been attracted to the African online gambling industry.

Population, no doubt, is a key factor, especially in the countries which are more economically developed and, as such, are likelier to have online gambling legislation passed. The potential return for investors in the African online gambling industry could possibly be huge, should everything fall into place.

Perhaps what is one of the most attractive selling points for the African market for investors is that license fees are considerably low in comparison to everywhere else in the world, averaging at $48,000. However, there can be various further payments depending on the country, such as making an investment in the local infrastructure in addition to having a certain amount in the bank.

Not just wealthy individual investors but financial institutions such as hedge funds and investment banks are also being convinced by the potency of the online gambling industry in Africa, with countries such as Nigeria being one of the most prominent. Recently, US-based private equity firms Andreesen Horowitz and Avenir Growth Capital made a splash with a $20 million commitment to a start-up African mobile gaming company Carry1st, which has tapped into the huge growth in telecommunications industry on the continent.

It appears that those regions in Africa that are likely to be the most prominent (at least initially) are the ones that already have the requisite infrastructure, not least much more sophisticated telecommunications, though, also having scaled considerably in fintech as well.

Paving the Way for More Global iGaming Firms

It is perhaps easy to understand why this move from 888 is not one that other established firms would look to make - at least not yet anyway. While there are, of course, various circumstances and other better markets to focus on, with stricter licensing and better infrastructure, the decision not to enter Africa, at least yet, could be one that haunts them.

888 are potentially trailblazers in a new market that could well take off, and if it does, they are in before the curve and (unlike any other start-up), they have the credibility to fend off any competition that quickly arises and, in addition, to gain expertise and significant exposure.

As such, if even more improvements are made on the continent in regards to the online gambling industry, and it then takes off, this will have been an extremely shrewd move from 888.

This then could lead to a domino effect, similar to what we see in most other emerging markets in this industry, with other operators deciding to take the leap. Both Entain and Flutter Entertainment are never far away from the metaphorical bandwagon and will be watching how events unfold with interest.

Meanwhile, Super Group-owned Betway has forged a reputation for itself over the last couple of decades by creating brand exposure via partnership agreements with sports teams, and this could be an easy way for the brand to test the waters in a new market.

What seems likely is that UK-based firm bet365 is unlikely to make a move fast and without taking everything into account. The company has an industry of entering markets that are heavily regulated in order to maintain trust with its customers, and this strategy has served it well over the last two decades. Entering Africa perhaps seems a step too far for the firm, especially with them being a ‘single brand’ company - this would certainly stretch it thin, particularly since it recently entered the Dutch, Argentinian and Canadian markets as well.

One factor that might point to an obvious clue is US potential intentions in the African online gambling market, especially considering that most of the outside investment has come via hedge funds and private equity firms that are based there.

Could an influx of US online gambling firms enter certain African markets or even make significant investments? DraftKings, in particular, has demonstrated the strength of its ambitions in recent years with its attempted purchase of Entain - could they look to acquire any gambling companies in Africa or simply apply for licenses?

Patience Will be Fundamental

Africa, in a number of industries, is still in its relative infancy as far as its growth is concerned, and patience, above everything else, will prove to be the biggest factor if the online gambling industry is going to be a success.

The iGaming industry in every successful market relies on a number of related industries being highly established, not least of which being telecommunications (including broadband). Fast internet speeds are absolutely vital, as is online security, in addition to offering multiple forms of safe payment methods.

While it does appear that Africa has witnessed a surge in both of these industries (fintech as well) over the last few years, the foundations are beginning to take shape. However, education is also vital - making sure that related governing bodies and regulators have all of the information that they need in order to guarantee the safety of players at online casinos and how best to police each one.

Naturally, each country will differ in terms of its regulatory strictness - some will vary in the tax rates, while others may want a hefty payment upfront and not be massively concerned with how often they carry out checks on each site. This is why making sure each market receives the requisite education is key.

For 888, it does, on paper at least, appear as though they are making a smart move, with very little downside and one that may see the brand really begin to dominate what could become a major new market in the future.

Review this Blog

Leave a Comment

User Comments

comments for 888Africa: A Considerable Risk or the Start of a Major New Market?