Baltimore Versus FanDuel: The Rise of Municipal Lawsuits Against Sportsbooks

In the heart of Maryland, a legal tempest has been brewing with potentially industry-shaking consequences. The City of Baltimore launched a high-profile lawsuit against FanDuel earlier this year, alleging that the sportsbook and casino titan employed misleading and predatory marketing tactics. And, it should be said - this is not a routine regulatory slap on the wrist; it is a strategic and substantial challenge to the very methods used by modern gambling brands to attract and retain users.

At the core of Baltimore’s case is the accusation that FanDuel used aggressive acquisition tactics that blurred the line between promotion and manipulation – of course, when that line is questionably grey and, arguably, designed in that way, this is where the case gets even more ambivalent.

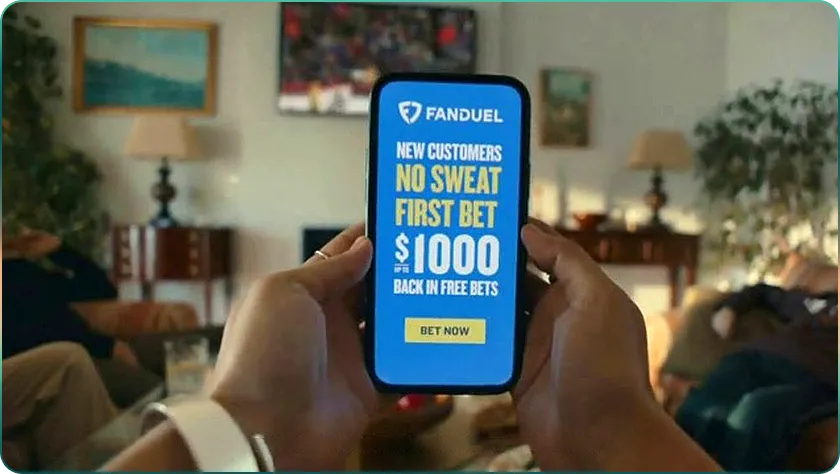

As such, the city claims that FanDuel’s marketing campaigns used misleading phrases such as “risk-free bets” and “no sweat first bets” to entice individuals who may not fully understand the potential financial consequences of gambling. Moreover, Baltimore alleges that these promotions were disproportionately targeted at vulnerable communities, particularly those in lower-income brackets, and at younger audiences who may be more susceptible to impulsive financial decisions.

FanDuel, for its part, has defended its advertising practices as industry-standard and compliant with state and federal regulations; however, objectively loose. The lawsuit has made headlines and is being closely monitored by other municipalities, attorneys general, and lawmakers across the United States. Baltimore’s bold move may act as the first domino in a chain of legal actions. As a result, it could push the industry to face a new wave of scrutiny and regulatory pressure.

In mid-November, that pressure escalated again. A federal judge sent Baltimore’s lawsuit against FanDuel – which also names DraftKings – back to state court after the companies attempted to move the case to federal jurisdiction. U.S. District Judge Stephanie Gallagher ruled that Maryland’s own courts are “far better equipped” to interpret the city’s consumer-protection ordinance and its relationship to state gambling law. The ruling effectively hands Baltimore a home-court advantage and keeps the next chapter of the case in a forum more attuned to local regulatory intent. The sportsbooks have already appealed to the Fourth Circuit, slowing the process but reinforcing how quickly this dispute has grown into a national test case.

This legal case is not only about whether FanDuel crossed a line but also about defining exactly where that legal line is and whether it needs redrawing. The outcome could establish a new benchmark for what is considered acceptable in sportsbook marketing, impacting both the letter and spirit of how gambling brands in the US communicate with consumers.

Could State Legislatures Seize the Upper Hand?

On the cluttered chessboard of modern governance, state legislatures may now feel emboldened to make their next strategic move. For years, many statehouses welcomed sportsbooks and both land-based and online casinos with open arms, enticed by the promise of increased tax revenue and economic stimulation. Bills legalising sports betting were passed with bipartisan support in numerous states; the momentum seemed unstoppable as state coffers gradually increased. However, Baltimore’s lawsuit signals a turning of the tide.

The fundamental issue being litigated is not whether sports betting or gambling should exist, but rather how it should be marketed and to whom. Many lawmakers have remained relatively hands-off with advertising regulations, often relying on self-regulatory bodies or vague advertising standards. But the lawsuit highlights how loosely defined promotional practices can become public policy pitfalls. As a result, state legislators who had previously ceded ground to industry lobbyists may now see an opportunity to reclaim regulatory power.

If Baltimore’s legal challenge gains traction, it could serve as a template for other states to follow. Legislators may seek to pass bills that more tightly regulate advertising language, restrict targeting parameters based on socioeconomic data, or even limit the number of promotional offers allowed per customer. These interventions could substantially reshape how sportsbooks operate at the state level.

Power, like water, tends to flow toward areas of least resistance. For a long time, sportsbooks wielded considerable influence over how rules were written. But if more lawsuits like Baltimore’s emerge, the power dynamic could shift significantly. Legislators, equipped with public support and legal precedent, might step forward with stronger oversight measures and more assertive compliance mandates.

Additionally, this shift may fuel political posturing during election cycles. Candidates could appeal to both social conservatives and economically progressive voters by promising to crack down on what they present as predatory gambling behaviour. This would mark a substantial shift in political alignment around gambling issues, one that reframes the debate from moral grounds to consumer protection and economic justice.

A Potential Blueprint for Regulatory Reform

The Baltimore vs FanDuel case may soon be viewed as more than just a lawsuit; it could become a foundational legal moment that changes the regulatory architecture of the gambling industry. Like a well-placed stone thrown into a still pond, the ripple effects may reach far beyond the borders of Maryland, with precedence being the prominent force.

Historically, sweeping regulatory changes often begin with isolated legal cases. Tobacco, opioids, payday lending and misleading credit card offers all began with lawsuits at the local or state level before ballooning into national reforms. Baltimore’s case contains the same ingredients: a popular yet controversial product, a clearly defined set of vulnerable victims, and a deep-pocketed corporate defendant.

If the city prevails or even reaches a substantial settlement, other states may follow suit, not only with lawsuits but also with tighter legislation. One potential outcome is a nationwide movement to ban the use of terms like “risk-free” in gambling advertising unless specific and verifiable conditions are met.

Indeed, another possibility is the introduction of mandatory “cooling-off periods” or “ad blackout windows” for new customers, especially those identified through behavioural tracking as high-risk users. The UK, at least, appears to lead the way in this and has laid down a benchmark in the ever-populating arena of responsible gambling.

The ramifications will not stop at advertising. Customer onboarding processes, terms and conditions, and even app interface design may be called into question as savvy software providers seek to find ways around this. Regulators may require that gambling operators implement more prominent loss disclaimers, clearer bonus terms, and more accessible self-exclusion tools.

It is also worth considering the international angle. European regulators have already tightened their belts when it comes to gambling promotion. The UK, for instance, has banned gambling ads featuring celebrities or social media influencers who appeal to under-25s. Canada has placed restrictions on inducements and bonuses. In the wake of Baltimore’s remand victory and the growing number of state-level actions in late 2025, the US is edging closer to those more conservative models.

Meanwhile, let’s not forget, there is more than just FanDuel in the US – while this might be one isolated case, there are certainly others that may be operating close to the line. Other major sportsbook and casino operators that could face regulatory heat include DraftKings, BetMGM, Caesars Sportsbook, and PointsBet.

Each has invested heavily in aggressive marketing campaigns across digital, television, and social platforms. Their frequent use of promotional language such as “no sweat bets” or “instant bonus” may draw similar legal scrutiny if deemed misleading or targeting vulnerable users. European firms expanding into the US market, like bet365 and Unibet, could also be exposed if state regulators adopt a stricter stance. As legal frameworks tighten, any operator failing to review its advertising language and targeting practices may risk significant fines or litigation.

There is also the potential for significant reputational damage to the industry if the public begins to associate sportsbook marketing with manipulation rather than entertainment. Operators that fail to anticipate this changing tide may find themselves playing catch-up in a far more restrictive and legally perilous environment.

Opportunity Knocks for Legal Titans

While the sportsbook sector may feel under siege, one set of players stands to gain from the turmoil: corporate law firms. The legal drama surrounding Baltimore vs FanDuel represents a lucrative opportunity for big-city legal giants, particularly those based in New York, Chicago, Washington DC, and Los Angeles. What may be a public relations headache for FanDuel is pure profit potential for white-collar legal eagles.

These firms are already preparing for an influx of work tied to the gambling industry. They anticipate not only direct litigation but also pre-emptive advisory work, compliance planning, and settlement negotiations. For firms with experience in class action defence, consumer protection cases, and advertising compliance, the opportunity is substantial.

The scale of this legal battle could require dedicated legal teams composed of litigation experts, advertising regulation analysts, and data privacy attorneys. Given the complexity of state-by-state gambling laws and the multi-jurisdictional nature of most sportsbook operators, managing these lawsuits will demand legal firepower few can deliver outside of elite firms.

As a result, some firms may develop dedicated gambling and gaming practice groups, offering cradle-to-grave legal services for operators. These services could range from marketing reviews and lobbying to litigation and damage control. Others may seek to position themselves as industry gatekeepers, advising new entrants and established players alike on how to operate within the new legal framework emerging from these lawsuits.

The potential payout for legal representation in these matters is not merely transactional. Firms that succeed in defending major operators or crafting out-of-court settlements may secure long-term relationships with sportsbook clients who will require ongoing legal services for years to come.

Just as Silicon Valley fuelled the rise of tech-focused legal teams in the early 2000s, the sportsbook and casino sector may soon create a new demand curve for gaming-specialised legal counsel. And for the firms that seize the moment, the financial rewards could be significant.

Ripple Effects Through the Gambling Ecosystem

While FanDuel may be the first operator in the legal crosshairs, the broader gambling ecosystem will undoubtedly feel the aftershocks of Baltimore’s lawsuit. Every layer of the sports betting and casino supply chain may be touched by a new wave of risk management, compliance tightening, and strategic reconsideration.

First in the line of fire are likely to be the marketing affiliates. These third-party content providers often amplify promotional messages on blogs, YouTube channels, and review sites. If Baltimore’s case triggers advertising reforms, sportsbooks may place greater pressure on their affiliates to fall in line or risk losing their partnerships. This would significantly impact the affiliate economy, which has thrived in part due to lenient and loosely enforced ad standards.

In-house marketing teams will also need to pivot. Messaging once seen as engaging or even humorous may now be reclassified as deceptive or coercive. Campaigns may require more legal oversight before going live. Creative concepts may need to be sanitised to avoid even the perception of manipulation. As such, the regulatory bottleneck will likely slow output, raise costs, and force internal teams to operate in closer alignment with legal departments.

Customer retention tactics such as loyalty bonuses, cashback rewards, and VIP tiers could face greater scrutiny as well. These mechanisms, while popular, could be seen as tools that incentivise risky gambling behaviour. If regulators follow the logic of Baltimore’s legal complaint, such features may need to be scaled back or redesigned entirely.

B2B technology providers may not be safe either, unless they’re able to find appropriate solutions. CRM systems, segmentation tools, and behavioural analytics engines that power bonus campaigns could be seen as accessories to the alleged harms being litigated. Providers may need to re-evaluate their platforms to ensure they do not facilitate the very tactics under legal challenge.

Even investors are watching closely. Publicly traded sportsbooks and their parent companies could face valuation pressures if lawsuits multiply or if the regulatory landscape becomes more hostile. Risk profiles will need to be adjusted. Strategic planning will need to account for new compliance obligations, legal liabilities, and marketing limitations.

At the consumer level, trust may be the ultimate casualty. If players feel they have been misled or targeted unfairly, brand loyalty will erode. Rebuilding that trust will require more than compliance; it will require a fundamental rethinking of how operators in the US view their relationship with users.

Review this Blog

Leave a Comment

User Comments

comments for Baltimore Versus FanDuel: The Rise of Municipal Lawsuits Against Sportsbooks