Key Casino Markets in 2021 and Beyond

The global casino industry has gone through a very turbulent year. While markets such as the United States registered record revenues, casinos in the rest of the world were desperately playing catchup. The casino industry will continue to face turmoil in the foreseeable future. New variants of the COVID-19 virus, The Great Resignation, and Mainland China's policies regarding gambling by its citizens will create uncertainty and instability for the global casino industry.

Introduction

COVID-19 continued to impact businesses the world over in 2021, and the casino industry was no exception. Pretty much every casino was shut down some part of the year, with many facing multiple closures. While some jurisdictions, such as the U.S., benefitted from the pent-up demand created by earlier COVID-19 restrictions, other markets are still coping with the virus and its attendant restrictions.

For many casino jurisdictions, the post-COVID recovery has started in dribs and drabs. Macau was expected to recover faster than most markets in Europe and North America, but we witnessed the exact opposite. The Special Administrative Region of Macau continued to enforce severe restrictions on tourists, which made visiting the SAR almost impossible.

So, what does the future augur for the world's casino industry? I'd like to comment on a few key developments and briefly touch upon the prospects for casinos in the United States, Macau, and Singapore.

The World’s Casino Panorama

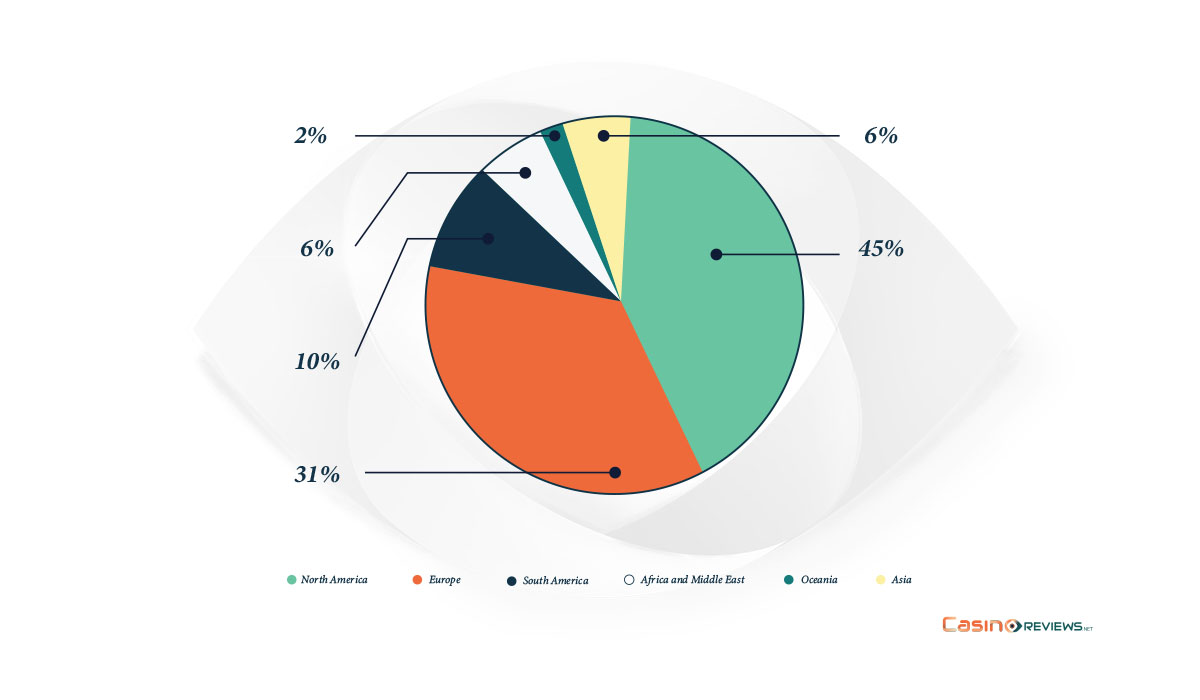

First, let us take a look at the location of the world's casinos. As shown in Figure 1, almost half of the world's casinos are in North America. Europe and South America rank second and third in terms of the number of casinos.

However, the number of casinos within a jurisdiction does not always equate with casino revenues. Macau, for instance, has only 41 casinos, whereas the United States has more than eleven times as many (465). Yet, Macau's casino revenues often rival casino revenues of all commercial casinos in the U.S. Most casinos in Europe are small in size, and the revenues they generate are also modest.

In this article, we shall focus on casinos in the United States, Macau, and Singapore.

The United States

The United States accounts for the majority of the casino establishments located in North America. U.S. commercial casinos' revenue plunged 31.3%, from around $44 billion in 2019 to $30.0 billion in 2020, the lowest level since 2003i.

In 2020, U.S. commercial casinos lost over a quarter of their normal operating days due to mandated closures to reduce the spread of the coronavirus. But the revenues have since rebounded, and commercial casinos are now seeing their revenues reach new all-time highs. Pennsylvania, Ohio, Maryland, and New Jersey are just a few of the states reporting record GGR this year.

The American Gaming Association reports that prior to 2021, no month had ever eclipsed the $4 billion mark in monthly commercial gaming revenue. In 2021, monthly GGR topped $4 billion in eight consecutive months. In November, the total commercial GGR nationwide was $4.75 billion.

Source: Global Casinos & Online Gambling (2021)

Future Prospects

It is unrealistic to expect casino revenues in the U.S. gambling market to keep rising like they have been for the previous few months. The casino industry is likely to face an imminent reversal in revenues for three reasons.

For one, the COVID-19 virus is continuing to take its toll on Americans, and there could be a marked increase in infections and fatalities any day. Currently, over 1,000 Americans are dying of COVID every single day. Rising COVID cases could lead to casino closures, caps on visitor numbers, and travel restrictions.

Second, most of the current revenue spikes stem from pent-up demand. Consumers had saved money during lockdowns, and this capital, in excess of a trillion dollars, is now finding its way into the coffers of the travel and leisure industry. Once the saved-up cash is spent — and the urge to travel has subsided — the revenues of the U.S. casino industry are bound to soften.

The third reason why revenues may start declining in 2022 has to do with The Great Resignation. Since April 2021 alone, more than 15 million Americans have quit their jobs. The pandemic has caused people to pause and take stock of their priorities and preferences. Government handouts and "work-from-home" experiences have, for many Americans, underscored the importance of work-life balance. Employees, by the millions, are moving away from jobs requiring shift work and unpredictable hours toward work that offers flexibility and a sense of purpose.

The hospitality industry is the one most impacted by The Great Resignation. Casino operators may find that they lack the workforce needed to service customers adequately. Employee shortage may cause casinos to shut off part of their properties or settle on delivering a less than optimal experience to their guests. In either case, the net result will be lower revenues.

Macau

Ever since the Special Administrative Region of Macau opened the casino industry to competition, the former Portuguese colony has become the darling of the casino industry and the leading gaming jurisdiction in the world. With casino revenues just in excess of $2 bn at the time of dissolution of the SJM casino monopoly, gaming revenues in Macau continued to skyrocket — except for a brief retreat during the Global Financial Crisis of 2008 and during 2015-2016 — when the government in Mainland China implemented stern measures to weed out corruption in government and business.

In 2019, Macau's 41 casinos generated $36.5 bn in revenues, representing almost 85% of the total revenues of commercial casinos in the entire United States. This figure plummeted to $7.58 billion in 2020, a drop of around 80%. Wynn Resorts, MGM Resorts, and Las Vegas Sands reportedly lost up to 2 million dollars per day during the shutdown of casinos in February 2020. Casino operators responded to the revenue slump by severe cost-cutting, including forced unpaid leave for several staff and "voluntary" redundancies. One casino company was offering around $50,000 incentive to its frontline casino employees if they quit.

Brokerage firm Sanford C. Bernstein expects Macau's 2021 revenues to be just below $11 billion, only around 20% of the peak gaming revenues in 2013.

Figure 2: Macau's Gaming Revenues 2010-2020 (1MOP=0.12USD)

The Future

The SAR Government of Macau has been extremely proactive in enforcing mandates to prevent the spread of COVID-19. With new variants of COVID-19 being incarnated every few months, free travel from Hong Kong and the Mainland to Macau will always remain a question mark. On November 24, 2021, Macau Business cited Fitch Ratings 2022 Outlook: Global Gaming Report, saying, "China's 'zero-COVID' policy will hinder the recovery of Macau's gaming sector in 2022 relative to other markets in the region that have accepted its endemic nature…."

The arrest of Alvin Chau, king of Macau's infamous junket operations, will also contribute to a huge drop in revenues. Macau observers say that Chau's arrest will result in a decline in VIP gaming revenues in Macau to the tune of 80 to 90 percent in the short term. VIP Gaming accounts for around half of Macau's GGR.

The third impediment to revenue recovery for Macau's casino operators is Mainland China's continued stranglehold on the gambling activity of its citizens. Macau's six casino operators will always be vulnerable to the Communist Party's opaque and unpredictable policymaking. China's Ministry of Culture and Tourism has a blacklist consisting of overseas tourist destinations it says are targeting Chinese citizens for gambling activities. It is not very clear whether Macau appears on the list.

Regardless, the Mainland authorities are making it very difficult for Chinese citizens to gamble anywhere. Access to funds for gambling via credit cards and underground banks is being stifled, and citizens caught gambling overseas could face fines, jail terms, or worse. All in all, when it comes to prospects for Macau's casino industry, most casino observers are, in hushed tones, echoing Merle Haggard, "Are the good times really over for good?"

Singapore

Singapore's two casinos opened their doors to the public in 2010. With profit margin ranging from 53 percent to 56 percent in the three years ending in 2019, Singapore's Marina Bay Sands had been touted as the world's most profitable gaming resort. Its competitor, Resorts World Sentosa, has not performed too shabbily either. In 2019, the property reported revenues of SG$2.5 billion and adjusted earnings before interest, tax, depreciation, and amortization ("Adjusted EBITDA") of SG$1.2 billion (EBITDA margin of 48%).

In 2019, the Singaporean government struck an SG$9 billion (US$6.7 billion) expansion agreement with the two operators to enhance the integrated resorts' signature features and Singapore's tourism proposition. This deal was signed and sealed before the first rumblings of COVID-19, back when the two casino operators were delivering joint EBITDA to the tune of $3 billion.

Both of Singapore's casinos were badly hit in FY2020, heavily affected by the three-month closure in operations between April and June and by ongoing restrictions on global travel. Resorts World Sentosa reported that full-year revenue for 2020 fell by nearly 90 percent, the worst financial performance since the opening of its property in 2010. Marina Bay Sands fared only slightly better, with casino revenues of $870 million, down from $2.17 billion (60%), recorded in 2019. During the times the casinos were allowed to stay open in 2020, both casinos faced restrictions on visitor numbers and the number of customers allowed at each table.

What Is Next

Singapore casinos have benefitted from a strong local market as well as a steady stream of customers from countries such as China, Malaysia, and Indonesia. Only fully vaccinated customers are allowed entry into casinos. This should not be a big issue for local customers, as 87 percent of the population has been fully vaccinated against Covid-19 (The Straits Times, December 16, 2021).

However, China's "gambling blacklist" could severely impact revenues for the two casinos in Singapore. Also, the sudden worldwide emergence of the Omicron virus could create severe restrictions or bans for tourists wanting to visit Singapore. In 2020, one of the casinos in Singapore was declared a "COVID Cluster" and was forced to shut down for fifteen days. Such closures are highly likely to manifest themselves if the Omicron virus spreads in the region.

Malaysian investment bank Affin Hwang Capital recently slashed its earnings forecasts for global gaming giant Genting Berhad for the next three years, blaming the downgrade on potential headwinds for the company's most profitable casino, Resorts World Sentosa.

In a note, the company said it was lowering the resort's revenue estimates by 1.7% for 2021, 17.6% for 2022, and 3.0% for 2023 "due to lower earnings contributions from Genting Singapore (operator of Resorts World Sentosa), as the discovery of the new COVID-19 variant is likely to delay the recovery of its earnings given its strong dependence on foreign tourists."

The discovery of the new COVID-19 variant has also forced some governments in the region to implement more stringent border controls, which could further hinder the recovery in international tourism and potentially depress casino revenues in Singapore. Based on available data and consensus opinion of gaming analysts, it appears that it will be in 2026 or even later that Singapore casino revenues will approach 2019 levels.

Conclusion

To quote the legendary Yogi Berra, "The future ain't what it used to be". The casino industry all over the world will face very challenging times in the foreseeable future. Land-based casinos will continue to face uncertainty largely due to the still ubiquitous presence of COVID-19. Casinos in Macau will have to deal with the added complexities of Mainland China's stance toward gambling.

One of the bright spots in 2020 and 2021 was the growth in online gambling. In the past couple of years, large casino companies demonstrated unprecedented interest in online gaming—including Las Vegas Sands—whose founder had previously spent millions rallying and lobbying against the legalization of online gaming. While these efforts on the part of land-based operators to establish a solid online presence will take some time to bear fruit, the writing is on the wall: Online gaming will achieve unparalleled significance in 2022 and beyond.

I feel Macau will lose some of its lusters as the world's gambling Mecca. Mainland China will continue its tight monitoring of overseas gambling among its citizens. Access to gambling funds among Chinese citizens will become even harder, and with the arrest of Alvin Chau, Macau's largest VIP junket operator, the death knell has been sounded for the hitherto permissive and secretive junket business. Just a few years ago, I had written that Macau's casino companies need to look at markets beyond China. Few people took this suggestion seriously. Many are now probably wishing they had.

I believe the casinos in Singapore will continue to struggle over the next five years. COVID-19 concerns and China's crackdown on gambling will significantly affect the two casinos' top line. The United States will struggle to maintain the revenues achieved in 2021. Labor shortages may detrimentally impact casino operations.

My hopes for 2022? I believe they are best expressed in Emergen-C's, A Love Letter to Normal Life, "I look forward to the day where a hug is just a hug, where a crowded bus or a crowded street or crowded park is welcome relief. A world where we can't wait to wait in line again…."

References:

iThe casino industry in the U.S. comprises of commercial casinos and those owned by Native American (Indian) tribes. The tribes generate around 40% of total casino revenues in the U.S.

Review this Blog

Leave a Comment

User Comments

comments for Key Casino Markets in 2021 and Beyond