US Online Gambling – Current State and Market Share

Good things sometimes take time. This appeared to be the general consensus just over three years ago, following an unprecedented global event that essentially forced numerous states across the United States to consider a previously (in many cases) unsolicited decision.

It was an obvious answer, certainly to recoup lost revenue in the state and one that had a significant amount of demand. Passing online gambling bills varies by state, with some aiming to expand the number of US online casinos, including slot and other casino game offerings. Meanwhile, other states are focusing exclusively on legalizing online sports betting. Yet, a third group of states is pursuing a comprehensive approach, legislating for the legalization and expansion of both

Michigan passing gambling legislation as one of the first of many states. This proved to be an almost overnight success story. In just one year, the state posted a gross receipts figure of $1.40 billion.

From 2021 onwards, there was an almost production line of online gambling bills passed in the US, each state going on to reap the rewards of the benefits brought from taxation of operators that had been granted licenses to offer their services in each respective state.

This wasn’t without a comprehensive amount of market research from each operator that had their eyes on almost monopolizing what they deemed to be a potentially very prosperous market, regardless of which state each one targeted.

Of course, there were operators that essentially had a significant head start in terms of being able to scale quickly and tap into a considerable market share immediately. The likes of FanDuel and DraftKings already had brand recognition due to their previously successful daily fantasy sports products, launched many years earlier (circa 2011).

Due to this being legal, because of a loophole in the legislation that deemed it possible (as it wasn’t direct gambling), it meant that over the best part of a decade, they had been able to build up trust among customers and brand awareness. They were essentially household names.

No doubt, plans were always in place for both brands to build out an online sportsbook, and when the first states passed online gambling laws, this eventually came to fruition in New Jersey in 2013. Some years later, in 2017, Pennsylvania online casino and sports betting markets also opened their doors for new players.

US Online Gambling Market’s Quick Evolution

From mid-2021 onwards, US online gambling was essentially accepted as a ‘necessary evil’ for most states, regardless of their political stance. It was clear that this was a major revenue generator, and they could not afford to leave any of it on the table. Especially following the economic turmoil left behind in the wake of the global pandemic.

The paradigm had changed. In the space of just one year, prime real estate space. Crucial for many businesses, advertising was governed by striking promotions from online gambling companies, monopolizing the major footfall. Hoardings and, indeed, digital screens were plastered with enticing offers from brands such as FanDuel and DraftKings, in addition to many others, all competing with each other for a place in the public consciousness.

Arizona: A Case Study in Online Gambling

In April 2021, Arizona passed a much-anticipated online gambling bill. Initial concerns were that this would detract from its core business and take revenues away from the brick-and-mortar casino sector.

To say this was a success would be an understatement. Between September 2021 and December 2022, the state generated over $54.4 million in gross revenue, with well in excess of $7.8 billion in wagers being accepted by the respective operators.

Meanwhile, in 2022, the US in its entirety set a record for online gambling revenue, with an unprecedented figure that exceeded $54.9 billion in revenue for the first 11 months, this previously being $53.04 billion for the entirety of 2021, according to data from the American Gaming Association (AGA).

Industry Opinions and Forecasts

“To have already surpassed the record numbers we hit in 2021 with a month to spare is really remarkable”, AGA senior vice president Casey Clark revealed at the time.

Regarding his outlook for 2023, he expanded: “The economy faced a lot of headwinds over the last year or two, but our businesses continued to expand and to grow”, he says. “I think we've got a strong foundation for continued growth”.

Meanwhile, Brendan Bussman - a managing partner at the consulting firm B Global, which specialises in the gambling and hospitality industry, mused: “Not only has the industry bounced back from the pandemic, but the industry has expanded.

Regarding his analysis for 2023, he continued: “It’s going to continue to percolate, and the industry will be in a good position for 2023, regardless of what happens with the economy.

We got to see where that discretionary income goes and where it stays”, he expanded when posed the question about how economic pressures could slice into discretionary spending.

The economy faced a lot of headwinds over the last year or two, but our businesses continued to expand and grow.

Performance of States

During 2022, out of all of the country’s 33 states that offer commercial gambling, 30 reported year-on-year revenue growth from the same period a year previously, the only three being Washington D.C., Mississippi, and South Dakota - each of these declining 15 %, 3.7 % and one % respectively.

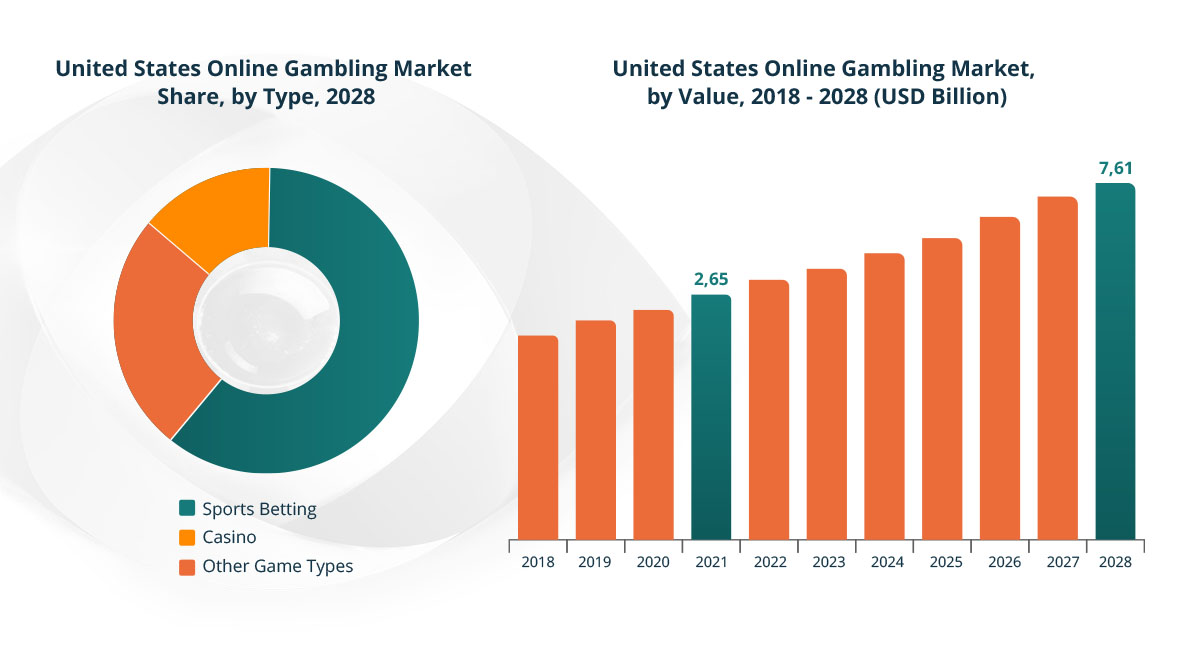

Out of all of the online gambling products in the US, it was slots and table games that generated the most amount of revenue, coming in at $43.79 billion (a 6.7 % increase on the same 11-month period in 2021). Meanwhile, sports betting accounted for $83.13 billion being wagered from January through to the end of November (2022). Despite this only converting to $6.56 billion in revenue, it was still a staggering 65.4 % increase on the same period a year previously.

Figure 1: United States Online Gambling Market Share

What Was the Major Catalyst for the United States?

While the figures recorded in 2021 were certainly respectable, it could be argued that there was an event that had a major influence on the wider US market - especially in terms of handle.

The Impact of Online Sports Betting Legislation in New York

There were tentative whispers in the third quarter of 2021 about the state of New York passing sports betting or at least some form of online gambling, and while there was initial opposition, this soon came to fruition.

As a result, an online sports betting bill was passed by state legislators, and this essentially opened the floodgates. Excitement surrounded the inner circle, who all recognised the vast potential that this would have, especially for the benefits of the state from an economic perspective.

Indeed, legislators imposed the heaviest tax levy on operators that were granted licenses - a staggering 51 %, a considerable increase from every other state (between 15 - 25 %).

Furthermore, there was only an allowance for nine online sportsbooks; this still hasn’t changed. Inevitably, these included all of the major heavyweights. PointsBet (Australia) was the only non-US operator to receive a license to operate. It could be argued that Genting-owned (Malaysia) Resorts World Bet could also be included in that category; however, it appears to have somewhat of a monopoly in the US.

Going live in the last three weeks of January 2021, the first figures considerably exceeded expectations. On top of the $200 million in licensing fees that went straight into state coffers, for the first three weeks of January alone, over $1 billion in bets were wagered - automatically beating the record of any state.

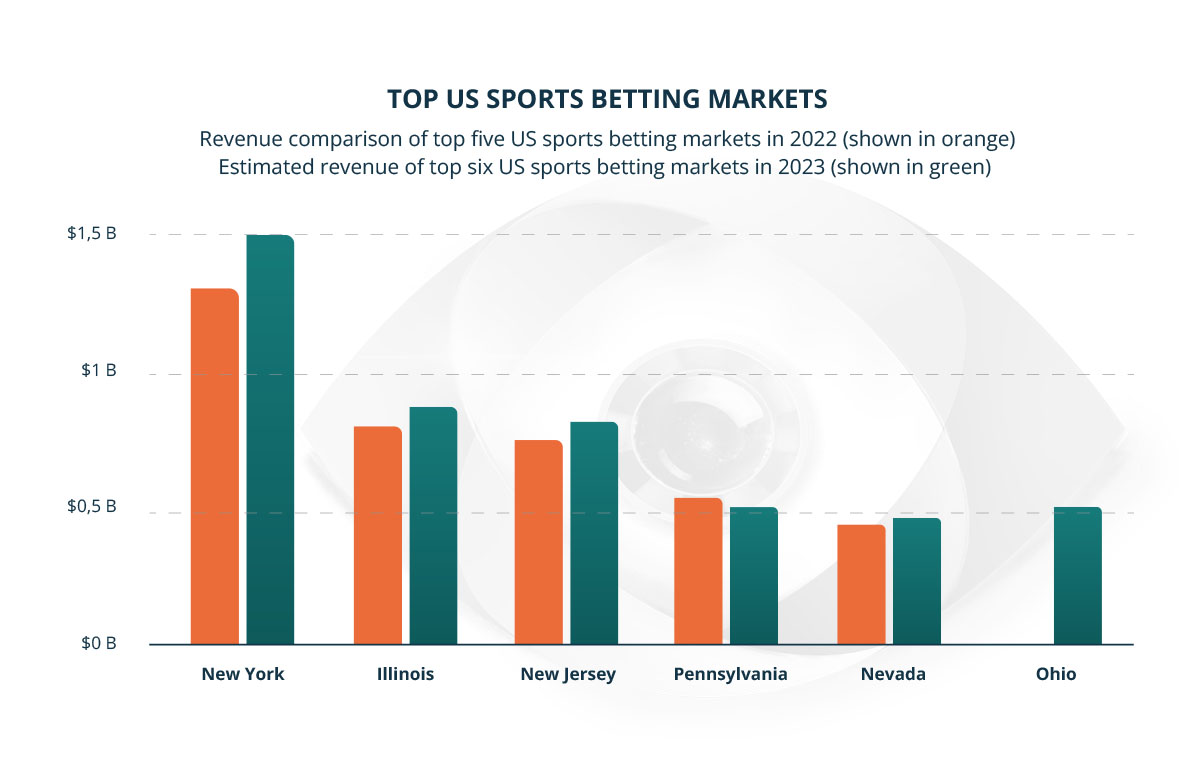

In the months that followed, New York continued on that trajectory, and by the close of 2022, it had generated a handle of $16.8 billion, total gross gaming revenue of $1.36 billion, and tax revenue of $693 million - and that was only with online sports betting (not online casino).

“It has been a remarkable, record-setting first year for online sports betting in New York with only nine operators,” Sen. Joe Addabbo revealed at the end of the year.

I’m grateful to have joined others in the state in putting for a product that New Yorkers deserved, and appreciate the benefits to our economy, in addition to educational and additional program funding.

Major Players in the State

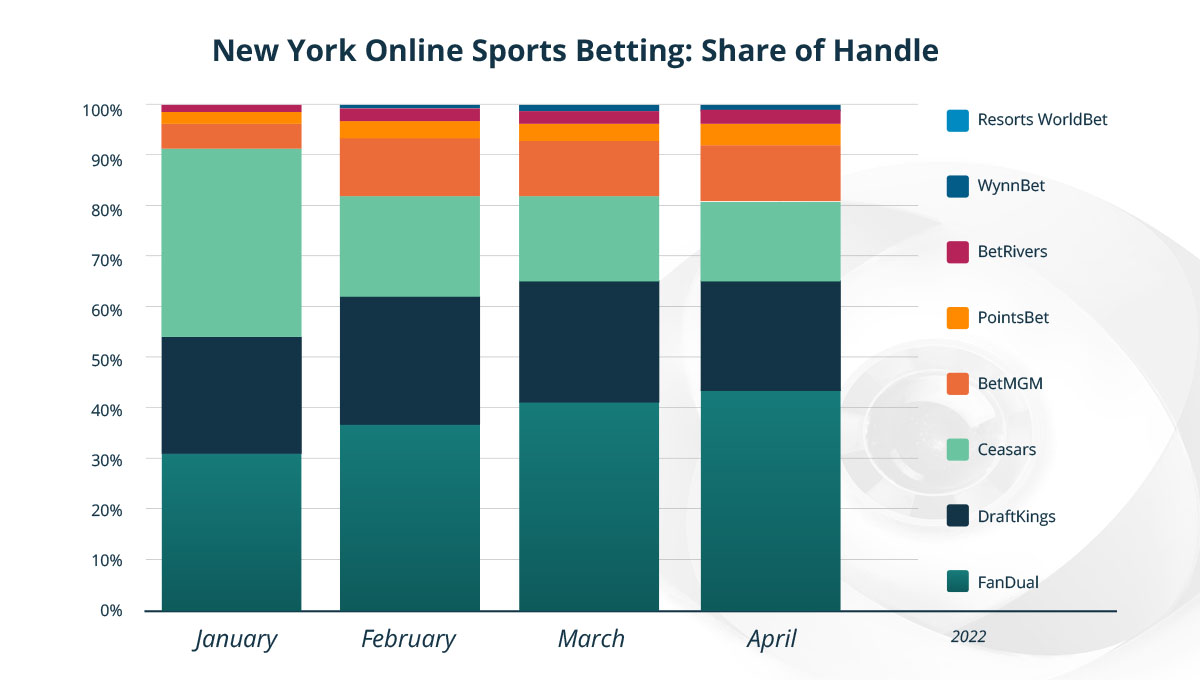

Unsurprisingly, FanDuel was the dominant sportsbook in the state, with a jaw-dropping 40 % market share during 2022, and continues to be. In 2022, it had a 48 % revenue share of the market, generating $650.5 million, in addition to $6.5 billion in wagers.

DraftKings inevitably came in second, with a 28 % share of the market ($4.5 billion), in addition to a 26 % revenue share of $354.6 million. Caesars Sportsbook perhaps pulled off a masterstroke to finish in third, following a high-risk gamble to offer a $3000 welcome bonus, which helped it to generate a 17 % share of the market ($2.8 billion), plus a 16 % revenue share of $214.6 million.

However, all eyes will be on swift mover BetMGM (jointly owned by MGM Resorts International and UK conglomerate Entain) - third in most US online gambling markets and fourth overall in New York for 2022, with an 8.3 % market share ($1.3 billion) in addition to a six % revеnue share of $81 million.

Figure 2: New York Online Sports Betting Shares

It has been no different in 2023. Despite the NFL season finishing, the state generated a landmark $1.5 billion in wagers for April, leading industry analysts to believe that the market is far from slowing down. Since launching, the market has generated nearly $25 billion in wagers, as of May 2023. Furthermore, the tax revenue generated is astronomical - close to $1 billion - $978.4 million to be precise, with the remainder of the year likely to creep towards to $1.5 billion mark for state tax revenue.

Following the close of 2022, Governor Cathy Hochul has been particularly vocal in her support for online sports betting in the state, especially highlighting the benefits that it has brought in terms of economic assistance for the state’s public industry sectors:

“In just one year, New York has become a national leader in providing responsible entertainment for millions while bringing in record-shattering revenue for education, youth sports, and problem gambling prevention,” she revealed in a press release.

I look forward to another year of delivering top-tier mobile sports wagering experiences that generate revenue to enrich the lives of New Yorkers across the state.

Meanwhile, Assemblyman J. Gary Pretlow, who was one of the initial advocates of the state’s online sports betting bill, revealed:

Mobile sports betting generated $709 million in taxes in just one year for essential programs such as Education, Youth Sports, and Problem Gambling related services. This is just the beginning, and I look forward to mobile sports betting generating more revenue for years to come.

Figure 3: Top US Sports Betting Markets

Outlook and Future Prospects for the US iGaming Industry

Certainly, in the short to medium term, the potential for the industry in the US is considerable. It is more than likely that we will see more states pass online gambling bills. One to watch, definitely is California.

Despite an online gambling bill being rejected last year, it would not come as a surprise for this to be refined and proposed again. Being the most populous state in the union with well in excess of 60 million people, this could contribute significantly towards the state’s coffers.

Because of that number, and similarly to New York, we could see yet another heavy tax levy imposed, while it is a state that has one of the biggest numbers of sports franchises in the US.

There have also been cautious predictions about the Big Apple state passing online casino legislation, which would likely lead to unprecedented revenue figures, particularly based on what has been generated just from online sports betting. Indeed, most states have seen that online casino has been responsible for the most amount of revenue and wagering handle – Michigan's online gambling success is one example.

New York has already adopted a more official approach to responsible gambling, following its extraordinary numbers and it is expected that other states will follow suit to appease any potential opposition.

While it is hard to look too far into the future about what might happen with the US online gambling market, some signs are already there. We could see 2023 transform it into the largest online gambling market in the world - even eclipsing the entire LatAm and European regions. Whether it has been a good thing or not, time now is certainly a luxury that the biggest operators cannot afford if they want to remain in the race.

Review this Blog

Leave a Comment

User Comments

comments for US Online Gambling – Current State and Market Share