What Are the Implications of Gamesys Being Acquired by Bally’s?

Bally’s has an almost synonymous standing in the US with gambling; unbeknown to many, the company began with just a single product - the ‘Ballyhoo’ pinball machine and took its original name from that in 1932 when it incorporated as ‘Bally Manufacturing Corporation.’

It has come a long way since. Numerous mergers, acquisitions, rebrands, and renames later, Bally’s Corporation as it now stands, has a clear and precise business strategy - one which has evolved significantly over the last couple of decades.

They have, for all intents and purposes, become an investment management organization, focusing on the gambling industry and their acquisition strategy over the last two years reflects that of a particularly astute mindset.

Merger and Acquisition Deals

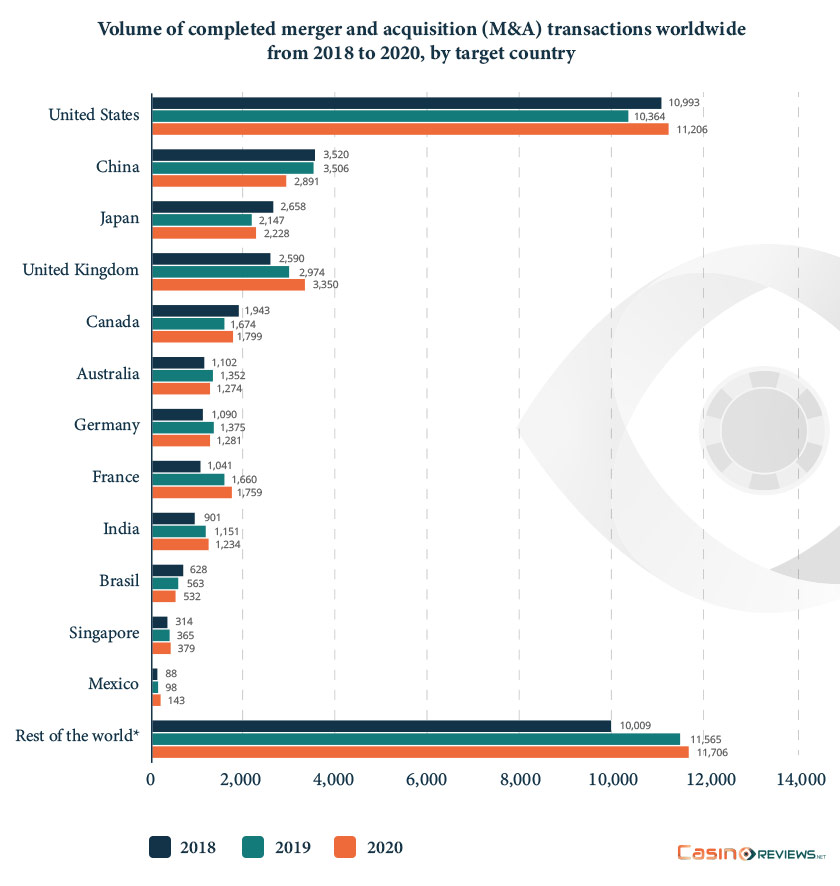

Merger and acquisition activity in the online gambling industry especially is nothing new. A statistic for the volume of merger and acquisition deals worldwide shows that the US is the country with most transactions from 2018 to 2020 (Figure 1). Over the last five years, this has increased significantly; however, compared to their competitors, Bally’s have demonstrated a clever, well-thought-out plan.

Up until July of last year, the company had been quietly going about its business, like Bobby Fischer, strategically aligning his pieces on a chessboard before unleashing his main strike.

Revered ancient Chinese general Sun Tzu philosophized, “every battle is won before it is ever fought” - and in Bally’s case, it looks unlikely to be a pyrrhic victory.

Having carefully and quietly gone about their business, each acquisition appeared to be slapdash, leaving no clue as to their overall strategy. It essentially began with the $85 million purchase of the naming rights for Sinclair Media Group’s 21 sports networks in November 2020, to take over from Fox Sports in a 10-year deal.

This was a move that essentially provided no clue to their competition about Bally’s future plan, keeping its cards close to its chest. Three months later, another seemingly innocuous acquisition followed when the company paid $27.5 million for Sport Caller - a B2B, free-to-play game developer based in Dublin.

There followed a move for Monkey Knife Fight - a fast-growing US fantasy sports company in April 2021 for $90 million, which suggested that Bally’s were looking to explore more of what has become a secondary industry in the country, following the mass legalization of online gambling.

When Bet.Works were acquired in June for $125 million, Bally’s intentions appeared to have taken shape - the sports betting platform perhaps being their ultimate prize all along, however, when the company announced its purchase of Gamesys less than one month later for an eye-watering $2.7 billion, it became clear that this was going to be the jewel in the crown.

Tactical Approach That Took Rivals by Surprise

What very quickly became clear when all the dots were joined is that Bally’s all along had plans to target the US market in a major way and, by being discreet about its true intentions, was able to keep major rivals such as DraftKings and FanDuel (undoubtedly the two major online gambling companies in the US) at bay.

Bally’s executed their plan to perfection; laying the foundations already meant that by the time that the company bought Gamesys, it was able to hit the ground running. With the previous purchases, it has the ideal combination as an entity in order to compete effectively in key markets.

Resources such as SportCaller, provide the company with an innovative game developer from which it can leverage the available technology for its other brands. Monkey Knife Fight gives it a significant database of customers in a related industry for which to market, while Bet.Works gives it the expertise to develop sportsbooks in what is going to be the biggest online gambling market in the world.

Taking control of Gamesys, an omni-channel online gambling company, with a number of small, boutique operator brands in different niches to its name, plus inhouse technology, Bally’s essentially has everything it needs to launch an assault on a new market.

While rivals DraftKings were targeting an ambitious, though somewhat unrealistic $21 billion takeover of UK conglomerate Entain, Bally’s more subtle approach saw it operate under the radar and now, are ideally positioned.

Why Is the Acquisition of Gamesys So Pivotal?

Over the last decade, the UK online casino operator has been operating in a similar way to Bally’s - they do not necessarily shout about what they do but instead let their results do the talking.

First and foremost, a high-tech software provider for the online gambling industry, it has also earned a glowing reputation for various forms of multimedia content in addition to having a strong grip on each of the different niches such as online casino, sports betting, and bingo.

Having this kind of portfolio provides a significant advantage for Bally’s, who now, with the acquisition of Monkey Knife Fight, have a fantastic opportunity for cross-marketing; indeed, arguably one of the largest databases in the industry to engage in this.

In the immediate aftermath of the takeover Soo Kim, Chairman of Bally’s Board of Directors, made the following statement: “Bally’s acquisition of Gamesys transforms our company into the premier omni-channel gaming company. We welcome the 1,800 members of the Gamesys team to the Bally’s family, and we welcome your strong technology capabilities and your proven international business acumen. We cannot wait to see what we are able to accomplish together in the US and beyond.”

Already, the US is proving that it can be one of, if not the largest online gambling market in the world over the next few years, with initial estimates already spiraling beyond the $120 billion mark, which continues to increase as more and more states become regulated.

It almost seemed as though Bally’s had a crystal ball to hand last year. While it was gradually going about its business, numerous US states were having online gambling and/or sports betting legislation passed, with Michigan, Virginia and Illinois all going live, while New York - arguably the most potent having this passed in September.

As we enter a new year, it appears more states are likely to follow after witnessing Michigan and Virginia post record results every month. The statistics certainly give Bally’s a clue as to where it can aim, and equipped with the omni-channel expertise of Gamesys, this provides an edge.

When considering that Bally’s also own land based casinos and racetracks in key states, as well as having 14 licenses, when it comes to launching a Gamesys brand in the US, it should not be a problem. The 10-year partnership with Sinclair Media Group means that the company has some of the most powerful channels in the country in order to gain awareness; combined with the content aggregation tools that Gamesys has at its disposal, this effectively makes the launch process a lot smoother.

Could Other Operators Regret Not Acquiring Gamesys?

It could be argued that DraftKings certainly missed a trick in not identifying the company as a takeover target instead of focusing all of their efforts on what was, from the beginning, effectively a futile attempt to buy Entain.

The purchase of the UK-owned conglomerate would have blown every other company operating in the US out of the water with over 25 brands at its disposal. However, DraftKings arguably naively assumed that the biggest problem would have been easily overcome.

It was presented in the form of an Entain-MGM Resorts International (a DraftKings US rival), a joint venture called BetMGM, a sportsbook aimed at the US market. This was the major hurdle to the deal, and MGM would have likely done everything that they could to persuade Entain not to sell, even using the joint-venture as leverage.

What very quickly became obvious was that DraftKings was showing all of its hands at once, a shock and awe strategy that ultimately failed. Unlike Bally’s, which appeared to demonstrate a lot savvier, DraftKings undoubtedly had an air of arrogance.

Gamesys certainly would have been a smart purchase - certainly cheaper and also would complement the offering that DraftKings have, in addition to the much-needed customer database.

It perhaps is surprising that FanDuel owner Flutter Entertainment (that has the brands PaddyPower, Betfair, Sky Bet, and PokerStars) did not enter into negotiations, though from a database perspective, all of these brands certainly post strong numbers.

For the foreseeable, all eyes will be on the US market, particularly where US-owned firms are concerned, and each one is doing what it can to fight its corner. Perhaps a concern for Bally’s is that DraftKings, FanDuel, and even BetMGM appear to have the lion’s share of the market in every state, which could lead to them having to innovate and strategize in order to change public opinion.

The 1,800 strong workforce that it acquired when purchasing Gamesys can be key in helping to change the way in which online gambling and sports betting is perceived in the US, with the marketing technology that has been developed in recent years already proving effective for its own brands.

Arguably, the key to unlocking the mass market potential is the media partnership agreement that Bally’s have locked in for 10 years, which can help them to conquer a state yet touched by any online gambling enterprise.

Can Gamesys Help Bally’s to Win in New York?

All eyes are certainly going to be on what is regarded in many circles as the most important state in the union over the next year, with experts already predicting that whichever company dominates the state will be the undisputed force in the US online gambling industry.

Such a prediction also poses the idea that perhaps, all along, Bally’s has had its eye on this; investing in a media partnership in addition to an omni-channel gambling company (Gamesys), plus its previous acquisitions, suggests that it was laying the foundations for an altogether bigger prize.

As far as potential is concerned in this industry, it does not come any greater than the ‘Big Apple’ and, considering the influence that the Sinclair Media Group has among various organizations in the state, such as Wall Street institutions, it could well be the case, that forces are already at work.

The unique customer identification tools that Gamesys has at its disposal can help to give Bally’s an edge in the market, while the media partnership can help Bally’s quickly become well-known.

Based in neighboring Rhode Island, Bally’s effectively has “eyes on the ground” in terms of being able to survey the hype of the imminent launch of online sports betting.

However, Bally’s chairman Kim has warned against operators engaging in unethical approaches in order to win customers in the state, recently commenting: “We’re very grateful to the governor and the state of New York for selecting Bally’s as one of the nine.”

One of the biggest potential pitfalls for operators, especially those that are less established, is the tax rate of 51 percent, which for some could be particularly off-putting, however, when considering the higher levels of disposable income available from potential customers (Wall Street bankers), it does appear to be justified.

“Obviously nine is not a lot of operators, and the 51% tax rate is quite daunting, but I think if anything the opportunity that will come for all the operators will mean all the operators will have to be more disciplined and clever about how we acquire and retain customers.”

Kim continued: “In a high-tax jurisdiction, you can’t get away with certain behavior, like over promotion and over advertising, because the lifetime value of your customer is going to be lower. You layer on the fact that it’s also surrounded by states that all have legalized gaming, including Connecticut, Pennsylvania, and New Jersey. Most of the population of New York lives close to the border of another state where it isn’t a differentiating experience, and it’s possible for those customers to go over. The whole point of this exercise is for the state and the operators in the state to keep those revenues in New York, and I think that is going to be the greatest challenge.”

Kim has also been considerably vocal concerning Bally’s online aims, stating: “That’s going to expand. There are going to be plenty of states that have online offerings where there are either no casinos to get, or we simply do not have one. New York is one of those states where there are some casinos, but the online skins are untethered. We believe in the national gaming business; we want Bally’s to really be an international gaming company, and we need to be everywhere we can be.”

Another Gamesys-Esque Acquisition on the Cards?

There is no doubt that Bally’s appears to have its strategy on point when it comes to acquisitions. However, after carefully identifying its current purchases, this needs to continue if they plan to grow further and expand into key markets.

While the company has shown a particular proclivity for software and innovation, this could lead it down a number of routes in the future, which may be determined by a number of factors, how certain markets perform (such as the US), in addition to others becoming regulated.

It could also see the company seek to purchase one or some online casino and sportsbook brands, but only if it sees value in being able to utilize its current assets with it in order to make it worthwhile.

Currently, there are many boutique software providers in the industry, especially those that specialize in certain niches, which might be deemed a valuable addition to the Bally’s family - the Baltic region, in particular, has a number of these.

Another purchase of the same kind of company on the scale that it bought Gamesys for, though, is unlikely and would, perhaps be counterproductive, which potentially gives a clue that Bally’s may either buy an existing operator or more likely entertain a joint-venture with an already established online casino (similar to Entain and MGM) and share resources.

Gamesys in the US?

One of the first acts of Bally’s following the takeover of Gamesys was to upgrade and increase its office space, moving to a bigger, more central area of London, providing clues that the plan was to aggressively expand its headcount over the next 12 months.

However, Bally’s will have eyes on how the wider organization performs in the US market and the role that Gamesys has on this, which, as a result, could have an influence on whether we see an office across the Atlantic.

Should this happen, it could mean that Bally’s decided to house a number of its online brands in one building, and from an efficiency perspective, this could be particularly effective. A cross-over between brands, in terms of knowledge and skill sharing, is likely to occur to some extent - it would certainly explain why Bally’s has engaged in such a strategic acquisition operation over the last couple of years.

For now, though at least, it seems as if the Gamesys brand will be staying firmly in the English capital, though it has not ruled out employees coming backwards and forwards if it deems it to be necessary.

Review this Blog

Leave a Comment

User Comments

comments for What Are the Implications of Gamesys Being Acquired by Bally’s?