Why Casinos Are Losing the CRM Game – The House Disadvantage

Customer Relationship Management (CRM) has become a ubiquitous fixture in a company’s arsenal for managing its customer relationships. Yet not many businesses are able to derive the inherent value from their CRM projects. The casino industry, in general, seems to be seriously underperforming when it comes to harnessing the full power of CRM. In Part 1 of our two-part series on CRM, we discuss five crucial mistakes typically made by casinos in deploying and using CRM.

Introduction

Customer Relationship Management or CRM - comprising of a set of strategic initiatives, frameworks, and tools to acquire and retain the right customers -- has now been around for more than 25 years. In 2003, I was among the very first to organize and plan CRM implementation for what was then the second-largest casino in the world. Back then, understanding CRM was in its infancy, and the technology supporting CRM was quite primitive.

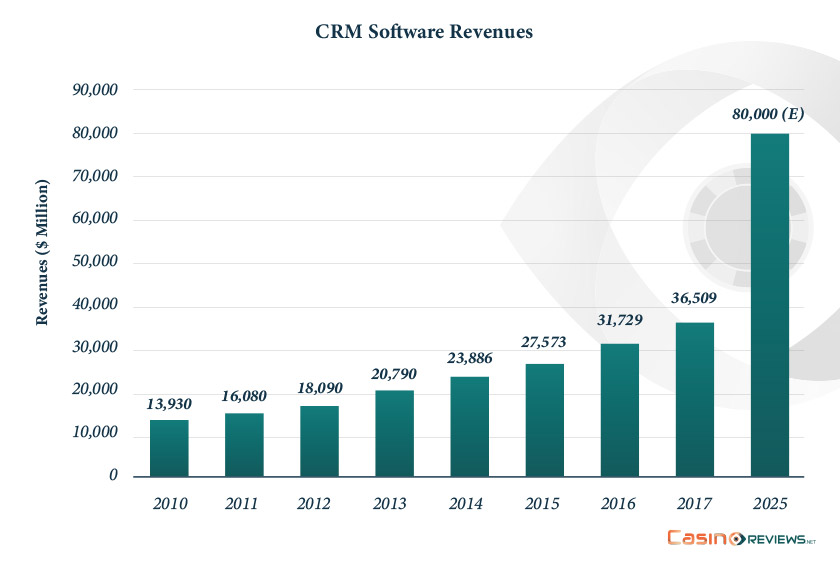

Today, most casinos, online and terrestrial, rely on some kind of CRM for their loyalty programs, customer segmentation, and customer retention initiatives. The global customer relationship management software market size was valued at USD 52.4 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 13.3% from 2022 to 2030. According to CRM solution provider SuperOffice, CRM software revenue is forecasted to reach $80 billion in 2025.

Successful CRM implementation involves more than buying software. My experience with CRM implementation suggests that software or technology, in general, makes up (or rather should make up) only about ten percent of all outlays needed for successful CRM onboarding. Huge costs are incurred in change management initiatives, business process reengineering, and training initiatives required for successfully implementing CRM.

Figure 1: CRM Software Revenues

Source: Adapted from 18 CRM Statistics You Need to Know for 2021 (superoffice.com)

CRM provides substantial benefits to businesses because of better understanding of customers, better execution of marketing strategy, more accurate assessment of a customer’s (or segment’s) value to a business, increased customer satisfaction, and higher customer spend. Given the benefits CRM can potentially offer users, the growth in adoption is only to be expected.

CRM allows businesses to have a 360-degree view of their customers. Such capability results in a better understanding of customer value, improved communication with customers, the capability of making the right offers to the right customers at the right time, the ability to upsell and cross-sell to customers, designing targeted loyalty programs, and enhancing the customer experience. With such an array of benefits, businesses that successfully harness CRM report increased revenues and higher profitability. Research suggests that a dollar invested in CRM initiatives typically yields nine dollars in returns for companies that properly deploy CRM.

The problem is that not many businesses that adopt CRM do it right. It is estimated that fully 30-55 percent of all CRM projects do not achieve their intended objectives or are judged to be abject failures. The failure rate is even higher for online and terrestrial casinos, many of which have traditionally viewed CRM as an IT initiative as opposed to a powerful strategy for creating customer intimacy.

It is a mistake to let IT drive CRM. IT professionals typically lack customer insights that marketing executives have; they are often far removed from setting the organizational direction or defining the strategic thrust of their organization. Entrusting CRM ownership to IT is not the only reason for CRM failure. There are ten key blunders commonly committed by companies en route to CRM adoption and implementation.

We shall cover five critical blunders in this article. The other five will be covered in Part 2 of the article due to appear shortly.

1. Ill-Defined Scope

There has been immense hype surrounding CRM, and the hype has given rise to unrealistic expectations. Oftentimes, there is a strong tendency to view CRM as a panacea for all marketing and operational bottlenecks. Consequently, many CRM projects suffer from what is known as “scope creep.”

Scope creep can be defined as “adding features and functionality (project scope) often without appropriate approval and without addressing the effects on time, costs, and resources.” Scope creep is harmful to a project, as a lack of focus leads to poor change controls and cost overrun. As the name implies, the scope of the project can creep larger and larger to ultimately ruin the foundation of the project.

Scope creep in CRM is usually attributable to four factors: (1) Not knowing what you need; (2) Not setting clear goals; (3) Not having a (good) plan for CRM rollout; and (4) Not understanding the complexity of CRM projects.

Ill-defined scope results in squandering of scarce resources and causes executives to lose faith in CRM. Consequently, many projects are abandoned mid-stream. Those projects which somehow reach completion tend to be unwieldy and dysfunctional, making CRM training and adoption next to impossible. Efforts devoted toward pointed CRM vision and delimited scope go a long way in carrying CRM to fruition.

2. No CRM Strategy

Most casino companies rush into CRM implementation without an explicit strategy. Executives believe that the software capabilities of a CRM system will automatically deliver positive results once the technical solution is implemented. Nothing could be farther from the truth. Technology, at best, buys you a seat at the table. In the absence of a cohesive strategy and processes to match, the CRM project is doomed to fail.

What exactly is strategy? There exist numerous definitions, but the one provided by Richard Norman and Rafael Ramirez probably makes most sense from the CRM perspective (emphasis mine):

Strategy is the art of creating value. It provides the intellectual frameworks, conceptual models, and governing ideas that allow a company’s managers to identify opportunities for bringing value to customers and for delivering that value at a profit. In this respect, strategy is the way a company defines its business and links together the only two resources that really matter in today’s economy: knowledge and relationships or an organization’s competencies and customersi.

CRM strategy development starts with a detailed assessment of a company’s business strategy and customer strategy. Prior to embarking on CRM, management needs to ensure that the business strategy is comprehensive, thorough, and forward-looking. The customer strategy involves examining the current and potential customer base and making clear choices about which customers to serve.

CRM strategy development involves considering the present and future position of the business and deciding how the company wants to address its customer base. According to Adrian Payne, a renowned CRM scholar, the chosen CRM strategy will depend on several factors, but two predominant factors dominate strategy formulation: (1) Completeness of customer information and (2) The extent to which the company wants to use this information to provide customized service.ii

Compared to most industries, casinos have exhaustive amounts of data on their customers. Also, in integrated resort casinos, there is a continuum along which customization of service is possible.

The one company uniquely successful in using customer information for providing customized offers to customers was Harrah’s Entertainment (now Caesars). The company had a focused strategy built on using comprehensive customer data.

An article in CIO magazine written way back in 2001 says, “Knowing when a customer last visited Harrah’s, for example, and which property and restaurant was visited, what games were played and how much was spent would enable the company to improve its service, customize the kinds of comps (free dinners, show tickets, and hotel rooms) it offered, and better tailor its marketing promotions. All of that would help tie customers closer to the Harrah’s brand and increase the company’s share of the U.S. gaming marketiii.”

Indeed, in the early years of CRM adoption, Harrah’s increased its revenues from $1.6 billion in 1997 to $3 billion in 1999.

3. No Customer-Centricity

Customers are the lifeblood of any business, but this realization has yet to dawn on many in the gaming industry. As I have mentioned several times in my previous articles, many executives in terrestrial casinos are firm believers in the “build it, and they will come” dictum. This orientation is product-centric, not customer-centric.

So, what does it mean to be customer-centric? Some characteristics of customer-centric organizations are:

- Using customer data to better understand and segment the customer base

- Identifying the best customers

- Focusing on creating products and services for the best customers

- Using Customer Lifetime Value (CLV) to segment customers

- Having a commitment to customer success.

The concept of customer centricity is not new. More than 65 years ago, Drucker (1954) wrote in his book, The Practice of Management, that “it is the customer who determines what a business is, what it produces, and whether it will prosper.” A 2003 Gartner report predicted that “Marketers that devote at least 50 percent of their time to advanced, customer-centric marketing processes and capabilities will achieve marketing ROI that is at least 30 percent greater than that of their peers, who lack such emphasis.iv”

Customer-centricity has its roots in the organizational culture of a business, and it finds expression in the organization’s values, norms, beliefs, and mental modelsv. Since customer-centric practices evolve from organizational culture, it takes time for them to be truly embedded within any organization. Many other mistakes responsible for CRM failure spring from a lack of customer-centric culture.

4. Lack of Top Management Support

CRM does not equate with installing a piece of software. It is a change in mindset of doing business, with customers at the center of organizational thinking. Such change is only possible with top management’s championing of the CRM initiative.

In a bottom-up approach, the CRM initiative is championed within a single group or division of the company. In contrast, a top-down approach refers to a situation where the CRM initiative emerges through strong support and sponsorship from senior executives and top management.

Without support and commitment from top management, even the most brilliant CRM undertaking is doomed to failure. Support for CRM is needed right from the start for the initiative to get off the ground. Without a commitment from top management, the CRM vision is unlikely to find any resonance in business reality. To be able to champion CRM, senior management first needs to understand what it means to the organization and what it entails in terms of time and money.

A few years ago, Bain & Company carried out a study of CRM failures. Drawing on examples from more than 200 companies across several industries, the study concluded that one of the major reasons that CRM fails is that most senior executives “don’t understand what they are implementing, let alone how much it costs or how long it will take.vi” In an Accenture CRM-related survey of business executives, more than half (55%) said that CRM shortfalls can be attributed in part to inadequate support from top management.

Top management drives the sentiments and culture in the organization; that’s why their early involvement in CRM sends a positive ripple effect through the entire organization. It is the job of senior management to ensure that CRM projects get the resources they need, that the appropriate climate for CRM buy-in across the organization is created, and that priority of CRM initiatives and commitment to its success are underscored in internal corporate communications.

Ignorance about Customer Lifetime Value

CRM is about attracting and retaining the right customers. The right customers are ones who not only produce reasonable revenues at the present time but those who have the potential to generate attractive revenues in the future. Customer lifetime value (CLV) is a measure of the future financial value of a customer’s purchases with an organization.

It is crucial for casinos to understand the CLV concept. CLV should decide how much money to spend in acquiring a customer and what retention costs for various groups of customers should be. Unfortunately, most casinos are clueless when it comes to assessing CLV.

CLV takes into account the following aspects:

- How much the customer spends on each visit and the resulting profit

- How often the customer visits your property or online casino

- How likely and how long will the customer be a customer in future

- How much does it cost to serve the customer

- What it costs the casino to acquire a particular customer

- The company’s discount rate (for calculating the net present value of future business)vii.

CLV’s power as a powerful CRM tool derives from five criteria:

- CLV takes a forward-looking stance regarding a customer’s value

- CLV includes all elements of customer profitability – theoretical win, player reinvestment, and customer behavior

- CLV recognizes the customer as the profit driver and not the product

- CLV analysis determines which customers to acquire

- CLV helps marketers adopt appropriate marketing activities today to increase profits in the future.viii

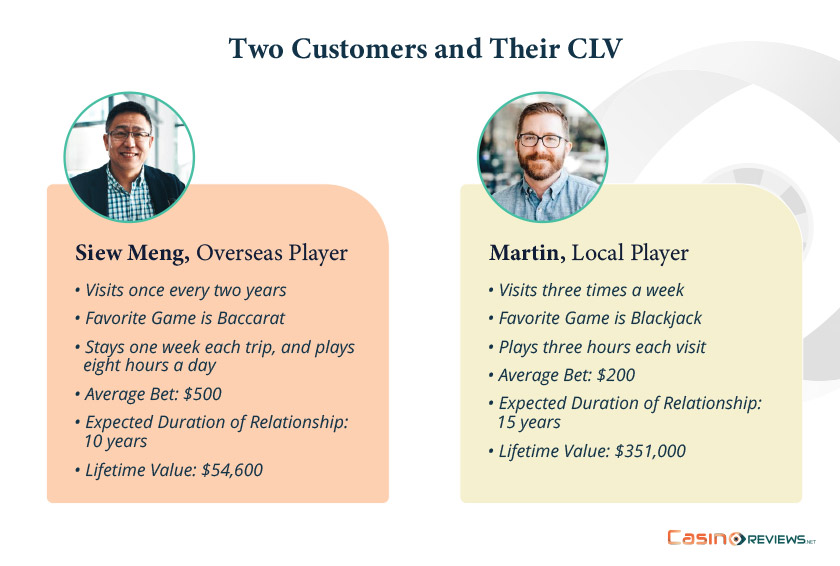

Very often, casino companies disproportionately reward less profitable players at the expense of more profitable ones. Let’s look at two customers at a local casino on the Gold Coast in Australia.

In the example provided in Figure 2, I have observed that the casino spends a lot more money trying to retain Siew Meng, the overseas player, than it does to retain the local player, Martin. We will not get into the specifics of CLV calculations for both players here. CLV is determined by the house advantage, game speed, average bet, visit frequency, duration of play, and estimated length of relationship with the player. Using these data to calculate CLV, Martin’s value to the casino is more than six times that of Siew Meng. Yet, most casinos go in search of itinerant big bettors such as Meng, whose value to the customer is relatively modest.ix

Figure 2: Two Customers and Their CLV

Source: Author’s observations and calculations

Conclusion

In the first part of this two-part CRM series, we looked at five serious lacunae typically seen in the deployment and use of CRM. Ill-defined scope, no clear CRM strategy, absence of customer-centricity, inadequate top management support for CRM, and ignorance of customer lifetime value all contribute toward CRM not achieving its objectives. Part 2 of this series will discuss five other areas where grave CRM-related mistakes habitually occur.

Read more:

iR. Normann and R. Ramirez (1993), “From Value Chain to Value Constellation: Designing Interactive Strategy,” Harvard Business Review, July-August, 65-77.

iiAdrian Payne (2006). Handbook of CRM: Achieving Excellence in Customer Management. Burlington, MA: Butterworth-Heinemann.

iiiHARRAH’S ENTERTAINMENT – Jackpot! Using IT to Manage Customer Information (cio.com)

ivMarcus, Claudio, and Kimberly Collins (2003), “Top-10 Marketing Processes for the 21st Century,” Gartner Group Report SP-20-0671. http://www.gartner.com.

vShah, Denish, Roland Rust, A. Parasuraman, Richard Staelin, and George Day (2006), “The Path to Customer Centricity,” Journal of Service Research, 9 (2), 113-124.

viRigby, D. K., Reichheld, F.F., and Schefter, P. (2002), “Avoid the Four Perils of CRM,” Harvard Business Review, February.

viiR. T. Rust, K. N. Lemon, and D. Narayandas (2005). Customer Equity Management. Upper Saddle River, NJ: Prentice Hall.

viiiV. Kumar (2004), “Maximizing Customer Profitability,” MSI Conference Presentation.

ixWatson, Lisa, and Sudhir Kale (2003), “Know When to Hold Them: Applying the Customer Lifetime Value Concept to Casino Table Gaming,” International Gambling Studies, 3, 89-101.

Review this Blog

Leave a Comment

User Comments

comments for Why Casinos Are Losing the CRM Game – The House Disadvantage