Maryland Sports Betting Tax Increase Signed Into Law

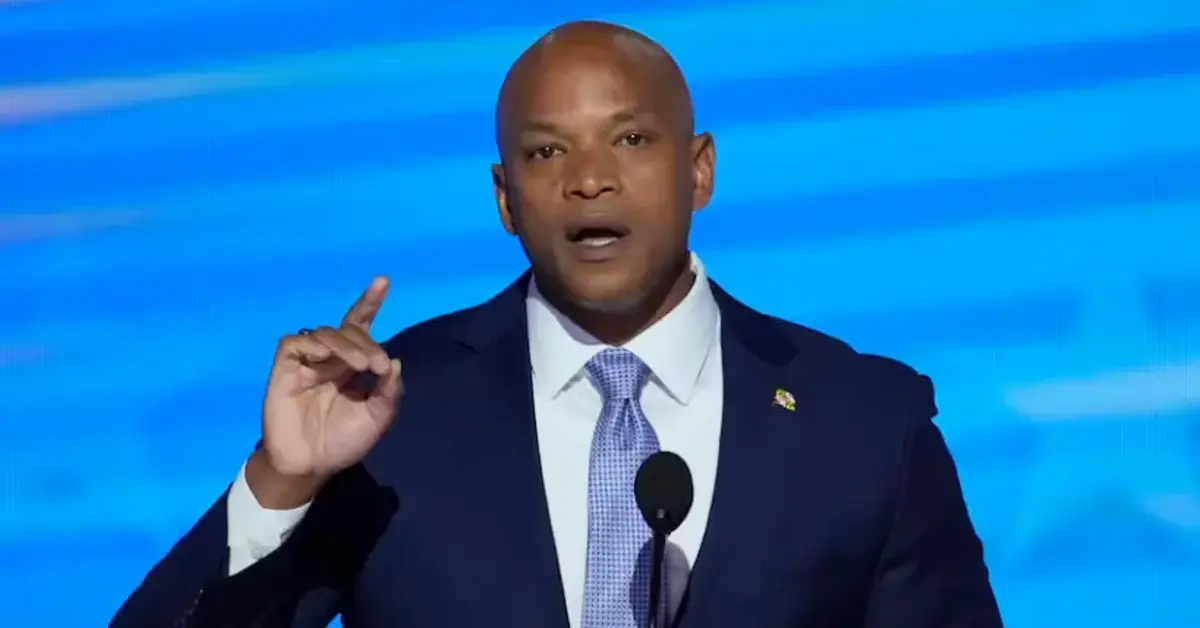

Maryland has officially raised the tax rate on mobile sportsbook operators following the signing of House Bill 352 by Gov. Wes Moore. The bill, part of the broader Budget Reconciliation and Financing Act of 2025, increases the tax on online sports betting revenue from 15% to 20%.

Initially, the governor had proposed a steeper increase to 30%, citing concerns about aligning Maryland's tax structure with neighboring jurisdictions and improving fiscal policy. However, after negotiations in the state legislature, the final agreed-upon rate settled at 20%. This compromise reflects both a desire to generate additional revenue and the practical consideration of maintaining a competitive business environment for mobile sportsbook operators in the state.

Related: Colorado Governor Signs Bill Ending Free Bet Tax DeductionsWith the signing of the new law, Maryland joins states such as Ohio and Illinois in imposing a 20% tax rate on mobile sports betting revenue. While the increase does represent a higher cost for operators, it remains more moderate than what had been originally proposed. The revised tax structure aims to address ongoing fiscal challenges and support public services, especially in education funding.

The law also introduces other changes to the handling of sports betting proceeds. Under the new structure, 5% of mobile sports wagering revenue will now be allocated to Maryland's general fund. The remainder of the tax revenue from both online and retail sports betting continues to be directed toward the Blueprint for Maryland's Future Fund, an initiative aimed at enhancing education in the state. Since the launch of legal sports betting in December 2021, over $160 million has been funneled into the education fund.

While the tax rate for mobile sportsbooks is rising, the rate for in-person sports betting operators remains unchanged at 15%. This distinction highlights the state's focus on adjusting the taxation of digital betting platforms, which have become increasingly dominant in the sports wagering market.

More Regulation

New Tax Necessary to Balance Budget

Gov. Moore, in a public statement regarding the bill signings, described the legislative package as a necessary step not only to balance the state's budget but also to address broader economic challenges. He pointed to an inherited structural deficit and a lagging state economy as primary motivators for the fiscal adjustments. The administration emphasized that the new measures were a direct response to both a budgetary shortfall and external economic pressures from federal policy shifts.

The broader sports betting industry continues to face mounting tax pressures across various states. In 2025 alone, other jurisdictions such as North Carolina, Louisiana, and Ohio have either proposed or are considering tax increases on sportsbook operators. In Colorado, a separate change is set to take effect next July that will prohibit operators from deducting promotional free bets from their taxable revenue, thereby increasing their overall tax liability.

Even before the Maryland tax increase was formally enacted, operators were already preparing for its financial impact. DraftKings, one of the leading online sportsbook platforms, noted earlier this month that anticipated tax and regulatory changes, including those in Maryland, would contribute to a projected $30 million reduction in 2025 revenue and a $26 million hit to adjusted EBITDA.

RELATED TOPICS: Regulation

Review this New Post

Leave a Comment

User Comments

Comments for Maryland Sports Betting Tax Increase Signed Into Law