Virtual Gaming Worlds to Begin Charging Sales Tax for Sweepstakes Coin Purchases

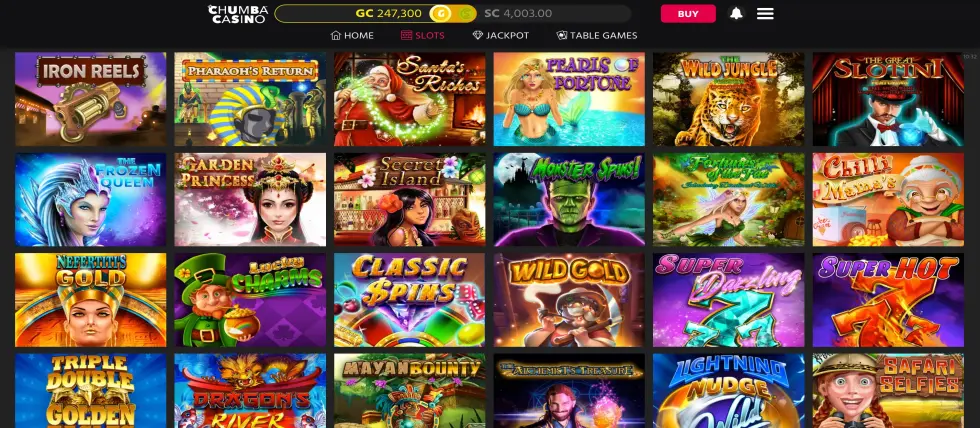

Virtual Gaming Worlds (VGW), the parent company of Chumba Casino, Global Poker, Luckyland Slots and other social gaming sites, has begun implementing sales tax on purchases made within its platforms. The change primarily applies to the acquisition of Gold Coins, a virtual currency used for gameplay across VGW's suite of online casino-style games.

The newly introduced policy represents a notable shift for the company, which has operated for years without applying sales tax to such transactions. This adjustment comes amid mounting scrutiny of the sweepstakes gaming sector in the US and evolving legal standards at both state and federal levels.

Related: New York Senate Approves Bill to Ban Sweepstakes CasinosVGW has updated its terms of service to incorporate the new tax requirement. According to the amended language, users in multiple US states will now see an added sales tax when purchasing Gold Coins. The applicable rate will vary depending on each user's location, following state-specific taxation rules.

Players in Kentucky, Illinois, Arkansas, Pennsylvania and Hawaii have already received notifications informing them of the changes. This rollout suggests that the company is gradually aligning its pricing and compliance practices with local tax regulations across multiple regions.

While the decision may cause concern for some users who have grown accustomed to tax-free purchases, VGW has acknowledged the change as a necessary measure to comply with an increasingly complex legal landscape. Company representatives have stated that the move reflects a need to adapt to current legal obligations and that users will be given detailed guidance and support to understand the implications for their accounts and transactions.

More Business News

Changes a Response to Legislative Efforts

The timing of VGW's policy change coincides with growing legislative activity targeting the sweepstakes gaming industry. In California, Assembly Bill 831 (AB 831) has drawn attention as it advances through the legislative process.

The bill seeks to impose sweeping restrictions on online sweepstakes casinos, potentially categorizing them as illegal gambling operations. Having passed a key committee stage, AB 831 is expected to undergo further consideration by state lawmakers in the near future. If enacted in its current form, the bill could force operators like VGW to exit the California market entirely.

In response to AB 831, VGW has indicated a willingness to contribute to state tax revenue as a way of preserving its operations in California. The company has emphasized that taxing its platform could yield approximately $149 million annually for the state.

By voluntarily offering to pay taxes, VGW hopes to shift the conversation away from prohibition and toward regulation. The company has encouraged policymakers to explore a legislative approach that fosters consumer protection while allowing digital gaming platforms to continue operating under clear rules.

VGW has also made additional legal adjustments for users residing in California. The company recently introduced terms that require California-based players to waive certain legal rights, including the ability to pursue claims under specific provisions of state law.

This change is designed to protect the company from future legal disputes, particularly class-action lawsuits, by limiting users' avenues for legal recourse. While such clauses are not uncommon in digital service agreements, their inclusion amid growing legal pressure signals a broader strategy to mitigate potential liabilities as the company navigates regulatory headwinds.

RELATED TOPICS: Business

Most Read

Must Read

Interviews

Interviews

Exclusive Interview: Levon Nikoghosyan Shares AffPapa Winning Formula for Successful iGaming Events

Dec 03, 2025 Interviews

Interviews

Review this New Post

Leave a Comment

User Comments

Comments for Virtual Gaming Worlds to Begin Charging Sales Tax for Sweepstakes Coin Purchases