Fair Bet Act to Reverse Controversial Gambling Tax Fails to Advance

American gamblers and poker players suffered a major setback this week after the Fair Accounting for Income Realized from Betting Earnings Taxation (FAIR BET) Act failed to move forward in Congress. The measure, which sought to amend the defense spending budget, was rejected by the House Rules Committee.

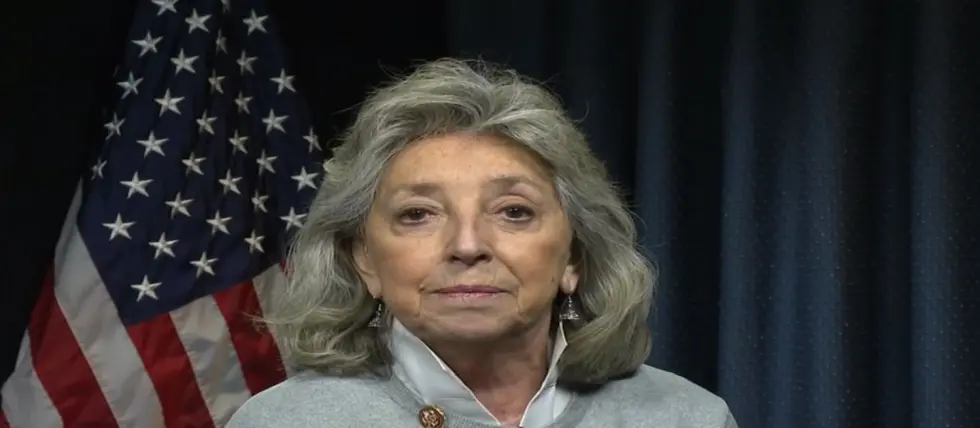

The proposal, drafted by Nevada Rep. Dina Titus to be added to the National Defense Authorization Act (NDAA), had been designed to shield professional gamblers from new tax provisions that critics say will unfairly penalize players who earn their living through poker and other forms of gambling. Rep. Titus has repeatedly argued that the new rules will create a situation where poker professionals could face tax bills even in years where they did not generate net income.

Related: AGA Pens Letter Supporting Reversal of New Big Beautiful Bill Gambling TaxUnder the present system, gamblers can offset their winnings by claiming an equal amount of documented losses. Beginning in 2026, however, this will change as a result of provisions passed in the One Big Beautiful Bill Act (OBBBA), signed during Donald Trump’s administration in July.

The adjustment limits deductions to 90% of losses, leaving players responsible for tax on the remaining 10%, regardless of their overall profit or loss position. For many professionals, this could mean paying taxes on theoretical income that does not exist in practical terms.

To illustrate the consequences, consider a player who earns $3 million in winnings but records $2.8 million in losses. Under current law, the full $2.8 million can be deducted, leaving a taxable profit of $200,000.

Once the new rules take effect, only 90% of those losses would qualify for deductions, amounting to $2.52 million. This adjustment leaves $480,000 in taxable income, even though the real profit remains $200,000. In cases where losses equal or exceed winnings, the player would still face tax liability despite breaking even.

More Regulation News

Regulation

Regulation

Hernandez Breaks Silence After UFC 324 Fight Canceled over Suspicious Betting

Feb 02, 2026A Missed Opportunity

Rep. Titus described the rejection of the FAIR BET Act as a missed opportunity to correct a problem before it takes effect. She maintained that the change was a simple fix that would have preserved fairness in tax reporting for gambling professionals. While acknowledging that her proposal had once again failed to gain approval, she confirmed her intention to continue pressing the issue in the months ahead.

The effort to reverse the tax provisions has drawn strong responses from high-profile figures in the poker community. Daniel Negreanu said the new tax structure represents one of the most serious challenges poker players have faced, describing it as a development of major significance that would have a damaging effect. Phil Galfond characterized the situation as deeply concerning for the future of the game, while Phil Hellmuth referred to it as the equivalent of a death tax for poker professionals.

Opponents of the law argue that the change undermines the financial viability of poker as a profession, where variance and swings are part of the normal course of play. By limiting the ability to account for losses, critics claim the rules create an unrealistic picture of income and profitability. Supporters of the FAIR BET Act believed the amendment to the NDAA represented the best chance to resolve the issue before 2026, but the Rules Committee decision closed that avenue for now.

RELATED TOPICS: Regulation

Most Read

Mississippi Committee Advances Bill to Criminalize Online Sweepstakes Casinos

Jan 29, 2026Giuseppe Iadisernia Wins Seminole Hard Rock Lucky Hearts Poker Open Championship

Jan 28, 2026Must Read

Interviews

Interviews

Exclusive Interview: Levon Nikoghosyan Shares AffPapa Winning Formula for Successful iGaming Events

Dec 03, 2025 Interviews

Interviews

Review this New Post

Leave a Comment

User Comments

Comments for Fair Bet Act to Reverse Controversial Gambling Tax Fails to Advance