Evolution Gaming Group Analysis – The Path to Success

A name synonymous with the current status of the industry that it operates in, Swedish online gambling organization Evolution Gaming Group is arguably one of the heavyweights when it comes to content creation and software development.

Striking the right notes has never been more important. While the industry offers much promise for those that get it right, the orchestral accompaniment requires a conductor who can make sure everyone is reading from the same score.

Step forward Richard Hadida, Jens von Bahr, and Fredrik Osterberg, who, upon founding the company in 2006, had a vision for a company whose core values and principles are still in evidence today.

At the heart of the business is an unmistakable commitment to innovation, with Evolution Gaming very quickly establishing itself as one of the industry’s most dynamic and forward-thinking software providers.

Recognizing a gap in the industry, Evolution Gaming’s game plan was astoundingly simple - to revolutionize the ‘live dealer’ niche, which at the time was perceived as more of an experimental afterthought rather than a serious contender.

The years that followed saw the founders’ strategy pay off significantly. By 2010, they had received their first industry awards, recognized as a true global player in the online gambling software sector for live dealer games, which was very quickly becoming a force to be reckoned with - especially with the development of smartphones. This meant that customers could play on the move and benefit from an authentic casino experience, from the comfort of their surroundings, with a device that could easily fit in their pocket. We asked ourselves the question, ‘What made Evolution Gaming truly evolutionary?’ The answers are below, so read on our full Evolution gaming analysis.

The Swift and Strategic Growth of Evolution Gaming

Firmly established as specialists in the ever-growing live casino niche, with a client roster that included some of the biggest operators in the industry, the company witnessed an impressive trajectory. They were effectively a ‘standalone’ in a sector that was swiftly becoming saturated; new, more boutique software providers were continuously looking for an ‘edge’ on their competition, and Evolution Gaming had the blueprint for success.

In the years that followed, their progress exhibited all the traits of a company whose potential was only limited to the imagination of that of the executive committee. Becoming somewhat of a magnet for the best software developers in the industry, they rapidly grew in size, with a workplace culture that was intoxicating.

Armed with the very latest in mobile software across multiple platforms, in addition to the industry’s top talent, Evolution Gaming’s intellectual property became the envy of their competitors, all of whom in the live casino niche were essentially fighting it out for ‘second-best’.

In 2013, the 100th live dealer table opened at their studio in Riga (Latvia), as it became the largest single-site operation in Europe, while they also added a Spanish studio to their network. By 2014, they opened a Malta office as expansion became the order of the day in a truly impressive fashion.

Malta was effectively the company’s international live casino hub, with dealers of multiple nationalities to cater to an ever-expanding client base, whose requirements necessitated personnel with a wide range of languages.

Either by chance or design, the company listed on the Stockholm Nasdaq in 2015, offering shares to the public; the first real indication that they were a serious heavyweight in the online gambling software industry.

Transition into M&A

It was not long before a number of industry insiders began to realize that Evolution Gaming had a clearly defined roadmap. Not content with staying small and just operating as a software provider, they soon began to identify further assets to strengthen their balance sheet in the long term.

In 2019, the company successfully completed the €15.8m acquisition of rival software provider Ezugi - a US firm that also specialized in Live Casino. CEO Martin Karlesund revealed at the time: “It is a very logical next step for Evolution which will increase our market share in key existing markets, like the US, where Ezugi’s presence and customer base will add to our on-going market expansion as well as add licensees in new markets, such as South Africa.”

One year later, during arguably the biggest global crisis since 2008, two more deals followed. The ink had barely dried on the paperwork needed to complete a deal for boutique firm Red Tiger before what was swiftly becoming a whale made its biggest splash to date.

A €1.8bn deal for Swedish rival NetEnt and one of the original ‘big three’ in the industry (alongside Microgaming and Playtech) followed, signaling a serious statement of intent that sent shockwaves through the industry.

Officially labeled as a ‘merger’, for those who were paying attention, this was a move possessing all of the hallmarks of a hostile takeover. Evolution, as they then became, was preparing to dominate the industry for years to come, with eyes on the progressive and potentially highly lucrative US iGaming market.

It was a clever move. NetEnt, over the years, have become renowned for their progressive jackpot slots especially, in addition to fan favorites such as Starburst. The former had become particularly popular with the new US market, who were sold on the idea of possibly winning a huge jackpot in one go.

Just over six months later, the powerhouse moved again - this time for Big Time Gaming in a deal that amounted to just over half a billion euros. Von Bahr, Chairman and also part of the original founding team, commented at the time: “With the addition of Big Time Gaming to our portfolio of slot brands, we strengthen our strategic position as the leading provider of digital casino games in the world. Big Time’s focus on innovation and creating unique playing experiences is a great fit with our culture and mindset at Evolution. We look forward to continuing our journey together.”

This dwarfed the €1 million acquisition of Digi Wheel (a spinning gaming wheels developer), which swiftly followed as the giant added yet more meat to its bones.

What Evolution’s Growth Means for the Rest of the Niche

Just like Entain (formerly GVC Holdings) have done in the operator sector of the industry, becoming a brand buyer - Evolution appears to have seized the initiative in the software vertical, essentially setting a precedent.

While other rivals have started to copy this model, Evolution’s advantage was that they now have the financial muscle behind them to compete, following their tactical plans spanning over the last decade.

For start-up companies, due to the success of organizations like Evolution, unless they carve out a separate niche for themselves, it is unlikely that we will see another big technology company in the online gambling sector.

What is more likely is that instead, they will focus on a small micro-niche that can serve the industry, with a view to being acquired by the likes of Evolution or Microgaming in the future, which we have already seen happening over the last few years.

As in the case of Digi Wheel - a start-up that identified an area where it could serve the operators, built up its reputation, and, for the founders at least, enjoyed the financial rewards of a few years of hard work.

This is essentially the same for operators. Many smaller firms that do not have the resources are becoming acquisition targets for conglomerates, which have transitioned their business model this way.

New markets such as the US certainly pose an interesting question. Set to become arguably the biggest in the world for the online gambling industry, the demand has almost certainly increased over the last couple of years, and this will almost certainly continue.

It means that there are still many opportunities in the software sector to cater to the US market, especially if (as is likely) new sportsbooks and online casinos appear. With the state of California set to vote in November 2022 on whether a bill for online gambling and sports betting should be passed, it opens up another interesting possibility.

Home to Silicon Valley - the undisputed technology hub on the planet, with multiple software giants as well as start-ups, this could become central to the US online gambling market, with the potential for advanced development in the online gambling technology niche more than capable of making an impact.

This could certainly be the case for next-generation technology that could be integrated into the industry, such as VR (Virtual Reality) or AR (Augmented Reality), to deliver an entirely new player experience towards gameplay.

It would be not too far a stretch to imagine Evolution focusing their efforts on this over the next year, especially when considering how much they have revolutionized the Live Dealer niche in the past decade.

How Great an Impact Has Software Had on the Wider Industry?

Arguably one of the biggest growing industries of the last decade and certainly the last couple of years - especially with the birth of new markets, there is no doubt that the online gambling industry as a whole is having an effect.

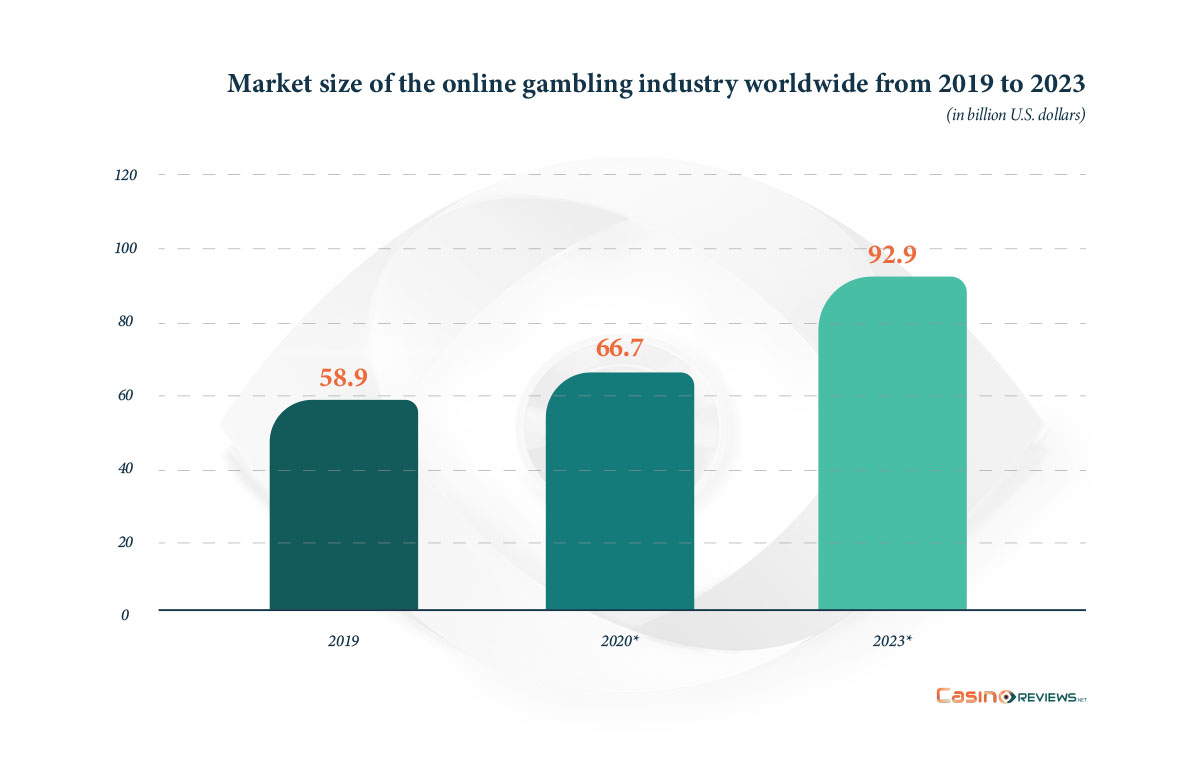

Figure 1: Market size of the online gambling industry worldwide – 2019 to 2023

However, the growth of the industry would certainly not have been possible without advancements and development in technology, or indeed the integration of such technologies into this industry.

Going even further back to the late 2000s, a radical shakeup of the mobile handset industry changed everything, opening up a whole range of possibilities in many different verticals - not just online gambling.

The introduction of smartphones was a gamechanger as far as the iGaming industry was concerned. Software providers that were quick to realize started to focus more on ensuring the player experience was as good as it could be for mobile users, while the savvier operators started to realize that they were getting more visits and crucially deposits, courtesy of smartphones.

It meant a radical shift in focus; essentially, every software provider and operator adopted a ‘mobile first’ approach to development, which opened up many more possibilities in the years that followed.

Data analytics became even more streamlined, enabling better and more focused marketing and customer acquisition methods, such as ‘push messages’ for existing customers with new offers and promotions, straight to their smartphone, where they could follow the link and deposit immediately.

However, app development became the next crucial advancement. Operators that had their own mobile applications essentially were able to gain substantial market share, and this was reflected in the quality and intelligence of their advertising campaigns. Television adverts would include a QR code that viewers could automatically scan on their Smart TV to send them straight to the promotion, or app store, while the adoption of celebrities as brand ambassadors, like Rush Street Interactive appointing Bobby Valentine, for example, using the app in their adverts, also played a key part.

Integration of more advanced payment methods was one of the next biggest technological impacts on the online gambling industry, with fintech beginning to become popular. PayPal - effectively the first payment gateway was one of the first deposit methods that operators integrated into their assets before many others started to follow.

This came at a time when customers were beginning to become wary about online security and the safety of their sensitive information, such as bank details. Those operators that realized this were quick to act and began to integrate other methods such as internet payment gateways. What these did was offer a separate layer of security to transactions, giving customers greater peace of mind.

Just recently, in conjunction with the fintech industry, cryptocurrency has started to become popular as a way of making deposits and withdrawals. However, this is still very much in its infancy as far as the effect that it may have on the wider industry is concerned.

What Is the Future for the Evolution Brand?

Having started in 2006, the software provider is one of the longest-running in the online gambling industry, and it will be interesting to see what comes next. No doubt, the founders will have some kind of plan or even exit strategy in mind, though whether they keep acquiring companies in the same aggressive fashion of the last couple of years remains to be seen.

No doubt, the biggest challenge for the company is still making sure that they can remain competitive in existing markets such as Europe while trying to gain significant market share in the US and even South America - another growing market to watch.

What this could mean is strategic acquisitions of software companies already based in these territories in order to gain access to their client portfolio. The key question will be whether Evolution have ambitions to develop their own standalone operator site and, if so, what their plans will be for it.

One company that does this already (albeit in reverse) is 888 Holdings, which is, for all intents and purposes, an operator company with multiple brands such as the recently acquired William Hill. However, they also have their own prominent B2B (Business to Business) division - Dragonfish, which develops unique in-house content for the 888 brands, as well as slots and games for a number of other operators.

It seems unlikely that the company will follow this route. However, their rebrand to ‘Evolution’ certainly poses interesting possibilities in terms of the direction that they might go in over the next few years.

Certainly, it appears there is no shortage of financing in the industry, as demonstrated by US operator firm DraftKings’ staggering $22 billion bid for Entain in September 2021, which was firmly rejected.

What cannot be called into question is Evolution’s commitment to quality and innovation, as reflected by the route they have adopted over the last decade especially. Their introduction of unique products such as Monopoly Live (including their ability to acquire the licensing) and Dreamcatcher Live has shaken up the live dealer model, and this undoubtedly helps them to stand out in the software sector.

Further development of unique content can help them to gain a significant hold on new markets like the US, and careful research into understanding what the customers there want and whether tastes are different to European markets can be vital to assisting in capitalizing.

As such, this is where a carefully planned acquisition of a small US technology firm in this market may make sense, as it would help to give them an edge in understanding customer preferences in addition to playing habits.

While online gambling definitely remains at its core, a move into sports betting software could also be an option that Evolution explore, especially as this niche of the industry continues to become popular - again, especially in the US.

Conclusion

For now, though, having gone from a company of three to nearly 5000 employees in 16 years, with annual revenue of $915 million, is a significant achievement.

The show goes on and appears to have no signs of stopping any time soon; this plot guarantees even more twists and turns before the music stops.

Review this Blog

Leave a Comment

User Comments

comments for Evolution Gaming Group Analysis – The Path to Success